Tariffs create a complex web of effects, and while they might seem to help domestic manufacturers at first glance, they often end up hurting them in the long run. We will be exploring this theme with historical lessons.

Frédéric Bastiat (1801-1850) was a French economist, writer, and a strong advocate of classical liberalism.

He was a vocal proponent of free trade and in his essay "The Law," Bastiat argued that the purpose of law should be to protect individual rights and property, not to redistribute wealth or impose one group's preferences on another.

“Now, legal plunder can be committed in an infinite number of ways. Thus we have an infinite number of plans for organizing it: tariffs, protection, benefits, subsidies, encouragements, progressive taxation, public schools, guaranteed jobs, guaranteed profits, minimum wages, a right to relief, a right to the tools of labor, free credit, and so on, and so on.”

― Frederic Bastiat, The Law

His work is often presented as an "antidote for economic illiteracy" regarding the "inadvisability of tariffs and price controls". You should read more about him, but for now we have to move on.

Trade Wars: A Recurring Theme in History

Tariffs are not new in U.S. history.

The 'infant industry'.

The origin of tariffs can be traced back to the early days of the U.S. republic, with a key figure being Alexander Hamilton. In 1791, Hamilton, then the Secretary of the Treasury, penned his influential "Report on Manufactures." This report laid out the economic philosophy that tariffs would be crucial for nurturing nascent American industries.

The 'infant industry' argument suggests that a temporary tariff is justified to shelter a potential industry in its early stages, enabling it to grow to maturity and eventually compete on equal terms in the world market. This is also remodeled as "strategic trade theory" - governments HAS a role in fostering national champions by providing them with temporary protection and support, enabling them to compete.

The Embargo Act of 1807

Passed in response to British and French interference with neutral U.S. merchant ships during the Napoleonic Wars, the Act closed U.S. ports to all exports and restricted imports from Britain.

While intended as a peaceful measure to protect American neutrality and maritime rights, it ultimately caused considerable economic hardship within the United States.

Exports plummeted from $108 million in 1807 to a mere $22 million in 1808, and also resulted in widespread smuggling, particularly through Canada, as merchants sought to circumvent the restrictions.

"When goods do not cross borders, soldiers will." ― Frederic Bastiat

But on the positive side, it led to the rapid growth of establishments manufacturing cotton goods, woollen cloths, iron, glass, and pottery.

The number of cotton mills increased from 15 in 1808 to 62 in 1809

Protectionist Movement: The growth in manufacturing led to a movement advocating for greater restrictions on foreign competition to protect these nascent industries.

"Tariffs are a tax on the consumer for the benefit of the protected industry."― Frederic Bastiat

McKinley Tariff Act of 1890

William McKinley's presidency and political career were closely associated with the issue of tariffs. He was a strong proponent of protectionism. In some sense, Trump is very much like him. During McKinley's presidency (1897-1901) - Hawaii was annexed (1898), Guam was ceded by Spain (1898), Philippines and Puerto Rico were also ceded to the U.S. by Spain after the Spanish-American War.

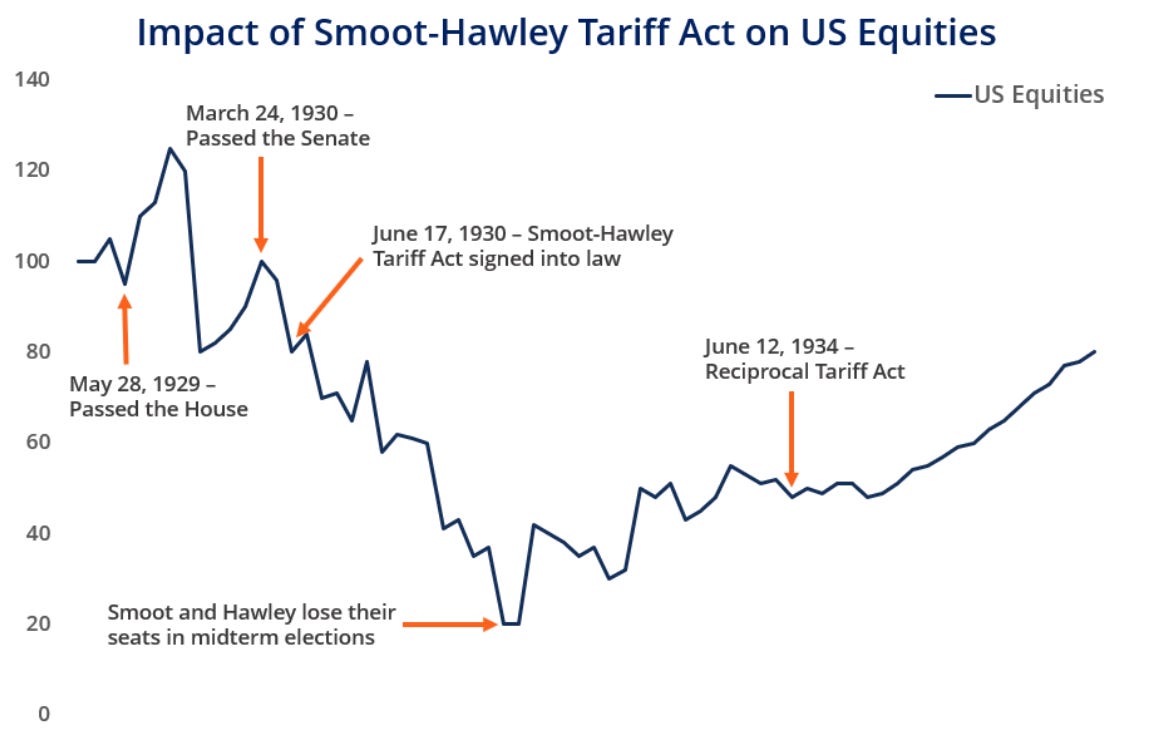

When Tariffs Go Wrong: The Smoot-Hawley Story

The Smoot-Hawley Tariff Act, formally known as the Tariff Act of 1930, was born out of a desire to protect American farmers who were struggling with falling agricultural prices and increased competition from imports. Initially focused on agricultural products, the act expanded to include a wide range of manufactured goods as various industries sought protection from foreign competition .

It triggered a wave of retaliatory tariffs from other countries, as trading partners sought to protect their own industries and economies . This escalation of trade barriers led to a significant decline in international trade, further deepening the global economic crisis .

Impact on Trade:

U.S. exports fell by approximately 40% within two years of the act's implementation .

Overall global trade plummeted by an estimated 65% between 1929 and 1934.

The decline in trade worsened the economic downturn, contributing to job losses and business failures. It also contributed to bank failures in several countries, particularly those heavily reliant on exports to the U.S..

Impact on Prices:

The act raised the price of imported goods, making them unaffordable for many Americans .

The combination of specific duties and deflation further increased the effective tariff rate, exacerbating the impact on prices .

Impact on the U.S. Economy:

Source: https://corporatefinanceinstitute.com/resources/economics/smoot-hawley-tariff-act/

While initially appearing to boost industrial production, the act ultimately contributed to a decline in U.S. GDP and prolonged the Great Depression .

The act led to job losses in industries that relied on exports or imported inputs .

The Economic and Political Drivers of Trade Conflicts

Historically nationalist sentiments have fueled trade conflicts, as countries prioritize their own interests (My Industries vs Your Industries) over those of others. It is a tool in broader geopolitical rivalries.

But what about the end consumers?

“The politician attempts to remedy the evil by increasing the very thing that caused the evil in the first place: legal plunder.”

“Legal plunder has two roots: One of them, as I have said before, is in human greed; the other is in false philanthropy.”

– Frédéric Bastiat

The global economy is increasingly interconnected, with nations relying on each other for goods, services, and resources.

The "benefit" of trade wars is often short-lived and limited. First, it only helps those manufacturers who don't rely heavily on imported components. Second, it can lead to retaliation from other countries, harming exports.

U.S. furniture manufacturers. Many rely on imported wood, fabrics, and hardware. Tariffs on these components increase their production costs, making their furniture less competitive, even if they're assembled in the US.

When countries specialize in producing goods and services where they have a comparative advantage, they can achieve higher levels of output and efficiency, ultimately leading to greater economic growth.

Investment Perspective:

Tariffs create a complex web of interconnected effects, can have unintended consequences that are difficult to predict. Such as, often hurting the very industries they aim to protect.

They drive up costs for both manufacturers and consumers, leading to a ripple effect that can harm the broader economy. If your country is in a second or third world country, it will create further the problem of affordability or inflation.

While tariffs might offer short-term protection for some, they often come at the expense of long-term competitiveness and economic growth.