Imagination vs. Reality: Investing Beyond the Traps.

"What If" Whispers, "Different" Lies: The Emotional Side of Investing.

Most failures in life don’t strike out of nowhere—they’re reruns of the same bad habits or blind spots we refuse to see. In investing, this truth runs even deeper.

Investing is a Game of Perspective. Perspective often is everything in Human decision making—it shapes how we interpret reality (past, present and future). Perspective doesn’t just shape reality—it is reality, at least until the numbers prove you wrong (provided you are ready to do that reality check). It’s also the filter through which we make sense of the past, present, and future guesses.

Hindsight reveals clear patterns, the present is a gamble against uncertainty, and the future is a calculated guess through probabilities. But, then Investing isn’t about nailing certainties—it’s about tilting the odds, knowing full well the game never promises a sure thing.

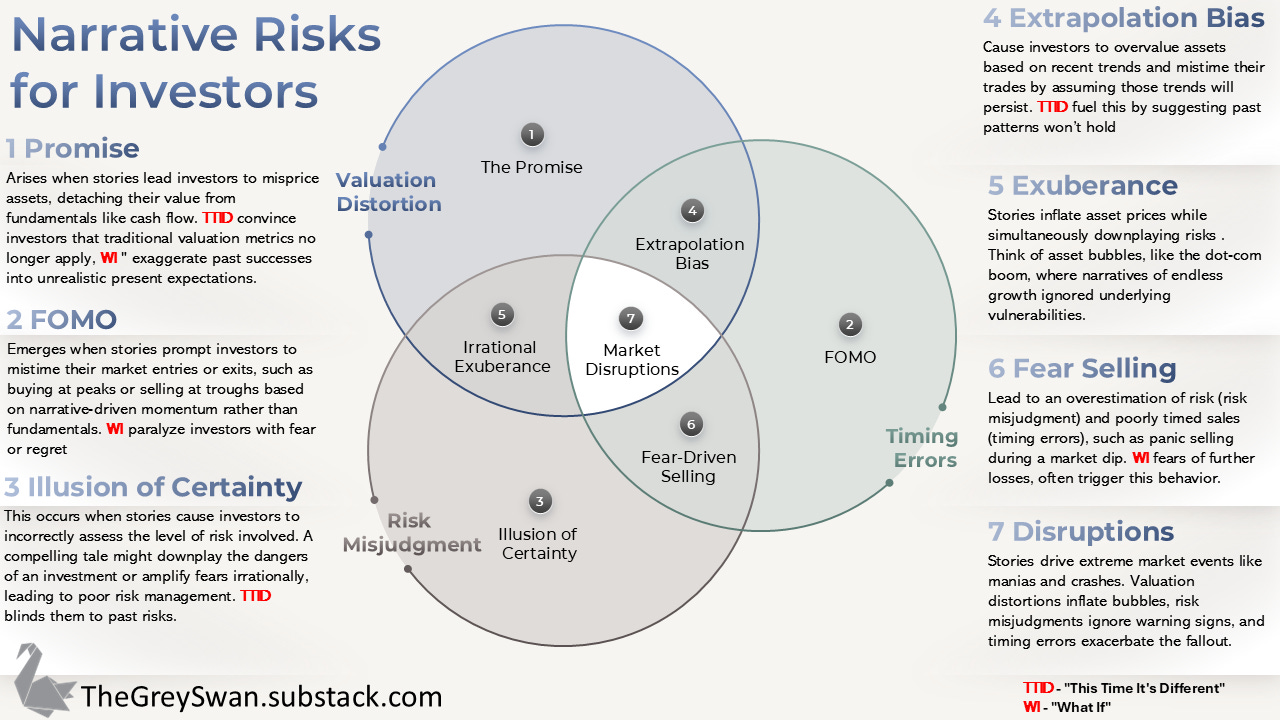

Here’s where it gets tricky: our love for stories, as behavioral finance tells us humans love stories—they help us make sense of chaos. But in markets, stories can inflate bubbles or deepen panic. And, in this unpredictable world, two seemingly simple phrases hold immense power to shape our investment decisions – for better or for worse: "What If" and "This Time It's Different."

What If

Jimmy Connors and Chris Evert’s romance was a classic case of tennis royalty coming together. Their engagement was announced in 1974, shortly after both won Wimbledon singles titles that year—Connors at 21 and Evert at 19.

But the fairy tale unraveled. Just weeks before the wedding, they called it off. Connors married Patti McGuire in 1979, and Evert wed John Lloyd in 1979 (later divorcing and remarrying others)—but their shared history lingered as a “what if” in tennis world.

A stable partnership might have amplified their success. Connors, who won 8 Grand Slam singles titles in real life, and Evert, with her 18, could have pushed each other to even greater heights. Their mixed doubles play could have become legendary. Off the court, they might have built a tennis empire—coaching academies, branded gear, or a family of mini-champions.

The phrase "What If" embodies the crucial human capacity for imagination and the essential need to consider future possibilities.

It’s First Half of 2022, and the Adani Green Energy stock is soaring past ₹2000. India’s renewable energy push has investors dreaming of a green goldmine.

For equity investors, fixating on "what if" distracts from the fundamentals—cash flows, earnings, balance sheets, and macroeconomic trends. Worse, it often fuels FOMO (fear of missing out).

It’s the itch to rewrite history, fixating on what could’ve been instead of what’s actionable now, and obsessing over alternate endings instead of playing the hand you’ve got. Thus, is the backward-looking daydream—reimagining history to fit a narrative of missed glory or alternate outcomes. It’s seductive because it feels analytical—playing out scenarios—but it’s often useless for decision-making.

The "This Time It’s Different" Delusion

"This time it’s different," is the forward-looking delusion—the belief that the old rules of economics, valuation, or human behavior no longer apply. It’s the mantra of most bubble, often tied to new technologies or infrastructure that promise to reshape the world. Mostly sharing a same pattern: initial excitement, wild overinvestment, inflated valuations, and an inevitable crash when reality catches up.

The core of this fallacy is the belief that current market conditions or economic realities are fundamentally unique and therefore immune to the cyclical patterns and valuation principles that have held true in the past.

It’s the illusion that old market laws—earnings, debt sustainability—bend for a new narrative. This mindset pumps bubbles, then pops them.

Almost all the bubble (the word got coined due to South Sea Bubble) rode a genuine innovation—trade monopolies (17th-century South Sea), rails (19th-Century Railroad Mania), electricity (1920s -Roaring Twenties) , TMT -Technology, Media, and Telecom(2000s) , or blockchain (recent). All of these did change the world, but just not the way speculators bet.

Most innovation take more time.

I love reading Steven Johnson’s books, ( one of the best writer on innovation). He argues that some of the best new products are slow hunches, i.e. ideas that incubate over long periods, gradually forming connections and gaining clarity. Nestle idea of selling coffee in small pods went nowhere for three decades. Most ideas need to simmer before they hit the jackpot. It’s like innovation sometimes plays the long game, waiting for the right tech or market vibe to click. It also occurs step-by-step, building upon existing ideas and technologies.

Apart from the Overoptimism, the "different" also do these:

Ignoring the Cyclical Nature of Markets: One of the most fundamental lessons of investing is that markets are cyclical. Periods of expansion are inevitably followed by periods of contraction, and asset prices tend to fluctuate over time. The "This Time It's Different" narrative often leads investors to extrapolate current trends indefinitely, ignoring the historical reality of market cycles.

The Justification of Elevated Valuations: serves as a rationale for justifying high or even exorbitant valuations. When asset prices appear stretched based on historical metrics, proponents of this narrative often invent new ways to value companies or argue that traditional metrics are outdated in the current "unprecedented" environment.

Novel Rationales and the Disregard for History: Market bubbles throughout history have often been fuelled by novel rationales that attempt to explain why traditional valuation rules no longer apply, and why one should ignores history’s lesson. But, value must eventually tie to reality—profits, utility, or tangible output.

Some examples of the "This Time It's Different" Trap from the Indian Market

Rise and Fall of Infrastructure Hopes: In the mid-2000s, with India's rapid economic growth, there was immense optimism surrounding infrastructure development. The narrative of "this time, India's growth is unstoppable, and infrastructure companies will deliver exponential returns" led to high valuations for many infrastructure firms. However, project delays, regulatory hurdles, and economic slowdowns eventually brought valuations back to earth, highlighting the risks of assuming a perpetual boom.

Small-Cap Frenzy: There have been periods in the Indian market where small-cap stocks have significantly outperformed larger companies. The belief that "this time, small-caps will continue to deliver superior returns indefinitely due to India's entrepreneurial spirit" can lead investors to overallocate to this riskier segment, ignoring the historical volatility and higher failure rates associated with smaller companies.

Promise of New-Age Businesses: With the advent of the internet and mobile technologies, new business models have emerged in India. While many of these hold genuine promise, the narrative that "this time, traditional profitability metrics don't matter for these disruptive businesses; focus solely on user growth and market share" can lead to investments in companies with unsustainable models and overinflated valuations.

Dissecting the Mistakes

Both mistakes share a common root: they prioritize story over substance. "What if" clings to a fabricated past; "This time it’s different" bets on an untested future.

"What if" locks us in a tug-of-war between past regrets and future fears, while "this time it’s different" blinds us to the past altogether. Together, they erode the discipline that separates speculation from investment. Neither respects the timeless drivers of value—cash flow, risk, and reversion to the mean.

So, What’s The Antidote?

It’s not about ignoring stories—we can’t—but about doubting them. Cross-check “What If” with probabilities, not just possibilities. Test “This Time It's Different” against history, not hype. Easier said than done when emotions are screaming louder than reason, but that’s where the edge lies. Predictable patterns only trap us if we let the same old scripts run the show.

"Investing, like life, is governed by probabilities, not possibilities. To succeed, one must weigh likelihood, not just potential. Afterall gambler plays possibilities; the investor plays probabilities."

Still, try to stick to what’s measurable—revenue growth, debt levels, market cycles—and tune out the noise. Connors and Evert didn’t win by rewriting their breakup or claiming the game had changed; they mastered the basics.

The End Note.

“I believe that imagination is stronger than knowledge. That myth is more potent than history. That dreams are more powerful than facts. That hope always triumphs over experience.” - Robert Fulghum

That’s not to say imagination has no place. Warren Buffett bet on "what could be"—as he ground it in evidence, not fantasy. He didn’t buy Coca-Cola in 1988 on a "what if" about its past; he saw its brand moat and predictable earnings. So, the difference is discipline: "what if" as a narrative indulgence is a siren call; "what could be" as a calculated thesis is a tool. And, for "This Time It's Different",

“The four most expensive words in investing are: 'This time it's different. '” -Sir John Templeton