In his 1942 book Capitalism, Socialism and Democracy, the economist Joseph Schumpeter listed Schumpeterian paradigm, that draws from three core ideas.

Innovation and the spread of knowledge are central to driving economic growth.

Innovation depends on incentives and robust property rights protection, stemming from entrepreneurs’ decisions to invest—fueled by the prospect of rewards.

New innovations displace older ones, rendering them obsolete and reshaping the economic landscape. This concept of "creative destruction," captures how innovation and technological advancements dismantle outdated economic frameworks while paving the way for new ones.

Creative destruction embeds a central dilemma within the growth process. Rents, or economic rewards, are vital to motivate innovators and drive innovation forward. Yet, there's a risk that yesterday's innovators might use those rents to block new breakthroughs, requiring a careful balance between rewarding past success and fostering renewal. The "creative" aspect manifests in the emergence of new industries and jobs, while the "destruction" involves the—wiping out—of old firms, skills, and markets.

"Extinction is the rule. Survival is the exception." - Carl Sagan.

Phases of the Technology Cycle and Their Impact

Often wave of economic growth is powered by a complete technological ecosystem (or cycle), not just single inventions. It integrates new energy sources, transportation, production methods, and consumer products into a self-reinforcing system that drives decades of expansion.

In fact, technology – new knowledge, new tools, what the Greeks called techne – has always been the main source of growth, and perhaps the only cause of growth, as technology made both population growth and natural resource utilization possible. -Marc Andreessen

The current AI Cycle will be one of those.

We’re at the cusp of the Slope of Enlightenment. The disillusionment is fading as businesses shift from chasing AI hype to embedding it for real-world impact.

India & Information Technology

We missed when the Industrial Revolution (1800s), wherein Coal and trains built factories, and Auto Age (1900s) when Oil and cars industrialized the West.

However, we were part of Digital Wave, it birthed Indian IT.

Global Capability Centres (GCCs) started emerging in India in the late 1980s and early 1990s. GCCs were primarily cost-saving hubs. India’s low operational costs, favorable exchange rates, and English-speaking workforce made it an attractive destination.

2000s – 2010s: As India’s IT ecosystem matured, GCCs began shifting from cost-focused units to value-added centres, all started with Y2K. This period saw them take on more complex tasks like software development, R&D, and analytics.

2010s – 2020s: GCCs evolved into strategic assets, driving digital transformation, AI/ML innovation, and product development. There was cloud cycles also.

Indian IT through various Technology Cycles (recent)

Under last Cloud Cycle (2010-2020): Cloud adoption saw TCS and HCL soar (7.5-10% CAGR) by partnering early with AWS/Azure.

But current AI cycle will move faster (5-10 years vs. 15)—here laggards will face quicker obsolescence. "FOBO"—Fear Of Becoming Obsolete—captures a visceral anxiety about being left behind in a fast-evolving world.

The Age of Adaptability: Breaking Obsolescence Trap

The software industry is on the cusp of a seismic shift. AI automation isn’t just a tool—it’s a force multiplier. By streamlining code development, optimizing workflows, and slashing operational costs, AI is poised to supercharge efficiency across the board. This isn’t a tech trend—it’s a paradigm shift. The companies and industries that adapt now will break free from the obsolescence trap, where clinging to old models spells doom.

Indian IT: A Legacy at a Crossroads

India’s IT sector, a $250 billion+ (Nasscom, 2024) juggernaut, has long thrived on outsourcing, custom software development, and a cost-arbitrage model.

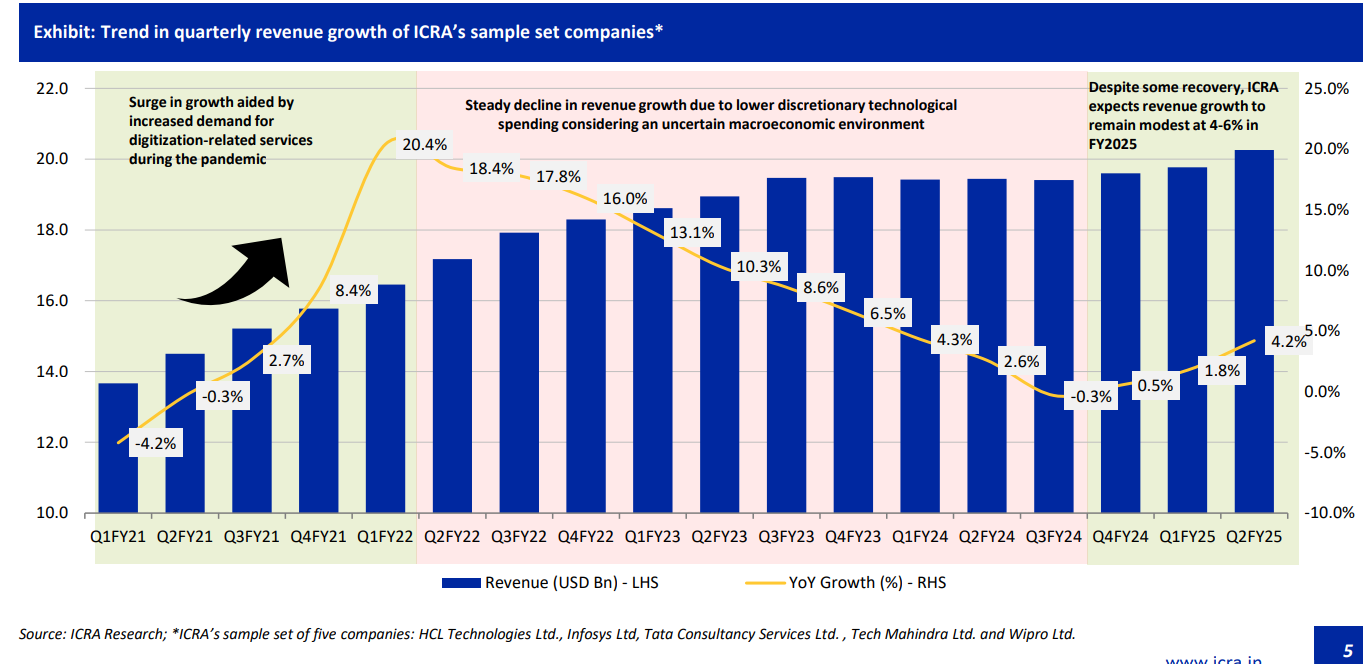

Giants like TCS, Infosys, and Wipro built empires writing code for the world. But the world has changed. They saw double-digit growth in the early 2000s and post-pandemic boom years. But recent macroeconomic headwinds— inflation, geopolitical tensions, and fears of recession—have led companies in North America and Europe to tighten budgets.

ICRA, a credit rating agency, pegged FY24 growth at 3-5%, with operating profit margins dipping by 70-100 basis points due to lower operating leverage. For FY26, ICRA forecasts a modest 4-6% revenue uptick, reflecting cautious optimism but no return to the glory days yet.

Is AI Eating the World?

Marc Andreessen's 2011 essay, "Why Software Is Eating the World," made a compelling case for how software companies were becoming the dominant force across industries. He argued that software’s scalability, adaptability, and low marginal costs were enabling tech firms to disrupt traditional sectors like retail (Amazon), entertainment (Netflix), and communications (Skype). Fast forward to the rise of AI, and this idea has evolved significantly.

AI doesn’t just automate coding—it redefines the game entirely. Why hire an army of developers to build a complex ERP system when an AI-powered, out-of-the-box solution can do it faster, cheaper, and smarter? Here’s how it’s shaking IT industry :

1. Eroding the Labor-Intensive Model

What’s Happening: Indian IT thrived on armies of coders building custom software—ERP systems, banking platforms, or CRM tools—from scratch. AI flips this. Pre-built, AI-driven solutions (e.g., SAP’s S/4HANA with embedded AI or Salesforce’s Einstein) deliver results without the grunt work.

Impact:

Shrinking Headcounts: A project that once took 200 developers 18 months can now be configured by 20 AI-savvy engineers in 6 months.

Cost Arbitrage Fades: India’s edge—cheap, skilled labor—loses value when AI slashes the need for manpower.

2. Speed Trumps Scale

What’s Happening: AI’s ability to deliver out-of-the-box solutions—think chatbots, predictive analytics, or supply chain optimizers—means clients want results in weeks, not years. Indian IT’s multi-year project cycles are suddenly dinosaurs.

Impact:

Client Expectations Shift: A retailer like Tesco doesn’t wait for a custom inventory system when an AI tool can predict stock needs off the shelf.

Startup Threat: Nimble players like Freshworks can deploy AI-driven CRM faster than TCS can pitch a bespoke alternative.

3. Value Replaces Volume

What’s Happening: AI aligns solutions with outcomes—efficiency gains, revenue boosts—rather than lines of code or hours billed. Clients no longer pay for effort; they pay for impact.

Impact:

Billing Model Disruption: The billable-hours gravy train (e.g., $50/hour per developer) crashes when AI delivers a $100,000 solution tied to a 10% cost cut.

Margin Squeeze: TCS’s 25% profit margins erode as clients demand value-based pricing over headcount-based contracts.

4. Redefining Skillsets

What’s Happening: AI doesn’t need coders to write every line—it needs integrators to tweak models, deploy systems, and manage outputs. The 5-million-strong Indian IT workforce faces a skills reckoning.

Impact:

Obsolescence Risk: A Java developer churning out ERP modules is sidelined when AI tools like UiPath automate workflows.

New Roles Emerge: Demand spikes for AI architects and data scientists—roles Indian IT must fill to stay relevant. Also create the urgency for upskilling

Real FOBO, Too much at Stakes

Indian IT isn’t just an industry—it’s an economic backbone.

GDP Contributor: Indian IT’s 7.5% GDP share, this grew from 1.2% in 1998 (Economic Times, 2024 archives), reflecting its rise as an economic engine and powering India’s growth story. Add, $194 billion exports make it a linchpin—too vital to falter.

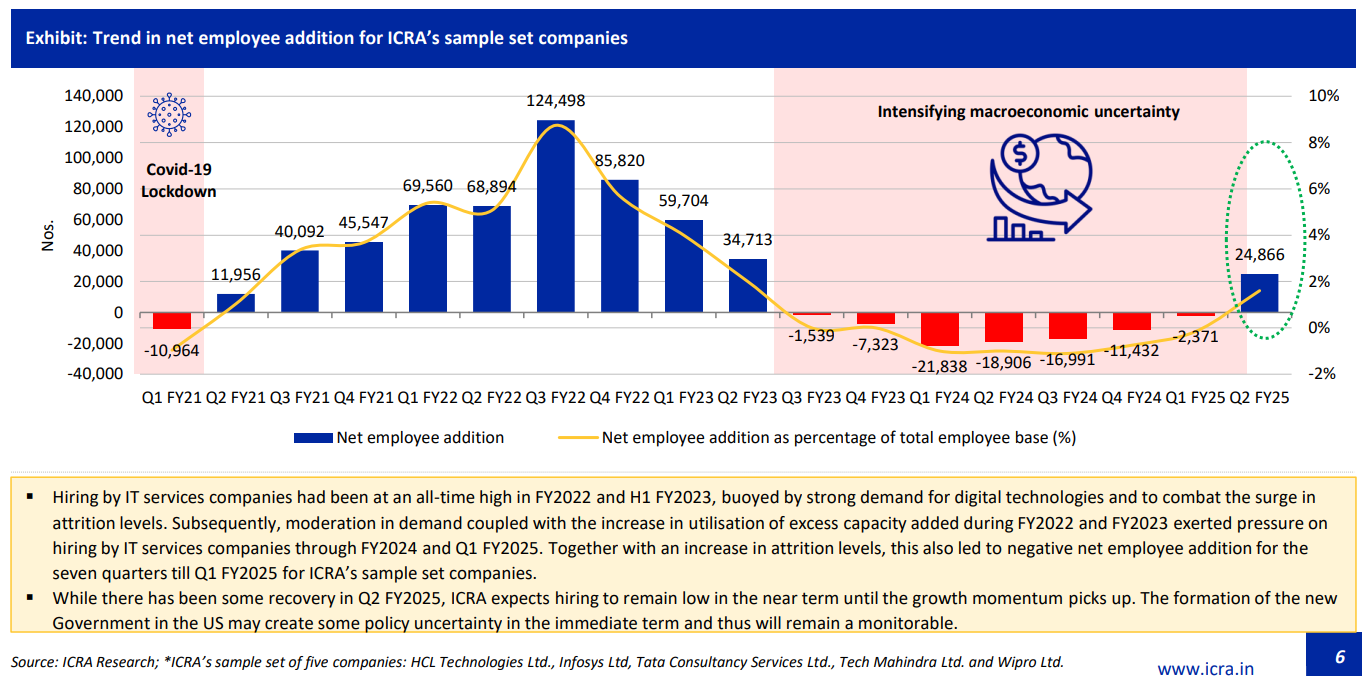

Employment Powerhouse: employs over 5 million people directly (NASSCOM, 2024), with indirect jobs (drivers, facilities) adding 10-12 million more (Economic Times, Jan 2025 estimate). TCS alone has 600,000+ employees (TCS Q3 FY25). We are already seeing ‘Negative net employee addition in recent quarters’, with some recovery in Q2 FY2025

For 30 years, Indian IT’s growth was a straight line—more headcount, more revenue. Add 10,000 developers, bank $500 million. Simple. Predictable. Done.

Too much is at stake for complacency. FOBO—Fear Of Becoming Obsolete—grips Indian IT. They are playing to their strengths—client trust, talent scale, and operational grit—to make AI pay off. Here’s how they’re responding:

Upskilling for AI: 5 million coders need AI fluency—designing, deploying, managing—or they’re sidelined.

Action: Infosys trained 250,000 in AI/ML (Infosys Q3 FY25), HCL 100,000+ (HCL Tech, 2024).

FOBO Angle: It’s a hedge—engineers shift from coding to AI design—but if software automates design too (e.g., Copilot’s 55% boost), labor’s still at risk.

Building AI Platforms: Revenue now comes from IP and outcomes, not headcounts.

Action: TCS’s Ignio, Wipro’s HOLMES, and HCL’s DRYiCE aim for Services-as-Software—e.g., TCS’s $2 billion AI deals (TCS Q3 FY25).

FOBO Angle: These are steps toward productization, but they’re niche vs. AWS’s breadth. Capital’s working hard here (20-25% margins), but catching SaaS Clouds giants needs a leap.

Partnering with Hyperscalers: AI’s pace leaves multi-year projects in the dust

Action: Infosys’s $10,000 crore cloud revenue (FY24) leans on AWS/Azure partnerships—e.g., a $2 billion AWS deal in 2023.

FOBO Angle: It preserves the safety net (~15% growth) but ties them to others’ innovation.

The New Reality is Revenue’s surging while headcounts flatline. TCS’s Q3 FY25 showed 10% of revenue from AI projects with no proportional hiring spike. Why? AI and innovation—IP, platforms, solutions—are decoupling the two.

Conclusion: Ready or Not, the Wave Is Here

On the Global AI Hype cycle, we’re on the Slope of Enlightenment, with firms like TCS (10% AI revenue in Q3 FY25) showing the way, but the Plateau of Productivity isn’t guaranteed (for Indian IT firms). FOBO—looms large, yet it’s a catalyst.

To ride this wave, we (they) must act now: deploy niche AI enterprise solutions fast, upskill 5 million workers into AI fluency, and price for impact, not effort. The next technology wave is here, and Indian IT’s adaptability—honed over decades—positions us to surf it, not just survive it. Let’s seize this moment, fuel innovation, and show the world what we’re made of. The future is bright—if we make it so, otherwise it would be another case study of creative destruction.

We had a problem of starvation, so we invented the Green Revolution.

We had a problem of darkness, so we invented electric lighting.

We had a problem of cold, so we invented indoor heating.

We had a problem of heat, so we invented air conditioning.

We had a problem of isolation, so we invented the Internet.

We had a problem of pandemics, so we invented vaccines.

We have a problem of poverty, so we invent technology to create abundance.

Give us a real world problem, and we can invent technology that will solve it.

-Marc Andreessen