Is Small Loans, Big & Beautiful in Indian Lending Space?

Easy Money: The Allure of Instant Credit.

26 years ago, I delved into Shakespeare's Hamlet for two years during my 11th and 12th grades. Vishal Bhardwaj’s Haider (2014) brilliantly reinterprets the play in an Indian context, but one of my most vivid memories remains the famous advice Polonius offered to his son Laertes:

Neither a borrower nor a lender be;

For loan oft loses both itself and friend,

And borrowing dulls the edge of husbandry.

This above all: to thine ownself be true,

Context: Avoid, lending and borrowing (within friends), when unpaid, lead to loss and strained relationships. borrowing can lead to complacency and a lack of financial discipline. Live within your own means.

We have seen this statement in almost every investor deck (in last decade) of BFSI players.

Relatively Low Debt: India's household debt, at XX% of GDP, is relatively low compared to other emerging markets (EMs)

Is TAM of Lending is so attractive?

Understanding the Appeal of Easy Loans.

Today, you can get loan under 20K (or 50K) with just few taps on your phone.

Convenience:

Seamless Integration: Embedded lending (plug-and-play) usecase can make anyone a Fintech. Like e-commerce sites, making access to credit more convenient to their users.

Starting slide from an Embedded-B2B2C platform, explaining their Thesis.

Speed:

Rapid Turn Around Times (TAT): New-age NBFCs are disbursing loans in under 10 minutes.

India Stack: Utilisation of Public Digital Infrastructure (PDI) such as Aadhaar eKYC, eSign, DigiLocker, and UPI streamlines the process.

Accessibility:

Wider Reach: For a decade Digital lenders backed by VC money to burn, have expanded financial services to previously untapped markets. We call them as New-to-Credit (NTC) Customers.

Mobile-First Solutions: Given the high penetration of smartphone users in India, lenders are creating customised experiences to target them.

The Simplicity and Complexity of Lending.

We have seen the easiness of Lending, now let’s focus on the other side.

“Life itself is simple….it's just not easy.” - Steve Maraboli

IDFC bank in their Q3 FY25, mentioned that:

Bank continues to de-grow its Microfinance portfolio, which as % of overall loan book reduced from 5.6% in Sep-2024 to 4.8% in Dec-2024 [ it was 7.2% in Dec-23]

Now, let me give you an interesting quote from their Q3 FY'25 Earnings Conference Call

“ So the microfinance business was an amazing silver bullet, which met 3 requirements. One, it made money. We were lending at 22%, 23%, 24%. We had some additional fees on top of it. Our cost of funds was really nothing like 6% or 7%, and it just made a lot of money……….” - V Vaidyanathan, CEO & Founder

So, why this Sweet to Sour Moment? We call missteps in lending as conservative stance. Lending at 22%-24% + additional fees, and cost of funds at 6%-7%. Microfinance has been a great extraction of value (from poor) for Banks.

Now, let’s change the track and move towards the other extreme end, towards Indian Fintech’s.

The Consumer Credit Boom

Post-pandemic, consumer credit has been a key driver of loan growth. In CAGR terms, it increased by 20.6% as compared with 14.8 % growth in overall credit (banks & upper and middle-layer NBFCs) between March 2021 and Dec 2023. [source: Financial Stability Report December 2024']

Between Sep 2021 and Sep 2023, CAGR was 25.5%, while the over all credit growth was 18.6 % [source: Financial Stability Report December 2023']

RBI’s regulatory measures implemented during Q3:2023-24 did curb bit of this growth. The moderation in consumer credit is reflected in both credit inquiry volumes and approval rates:

Note: The segregation of risk tiers are based on CIBIL scores is as follows-Super Prime:791-900; Prime Plus: 771-790, Prime:731-770; Near Prime:681-730; and Sub Prime: 300-680.

Other key insights from Financial Stability Report December 2024 are:

Loan Growth Moderation Across Income Categories: After a high growth phase during 2021-23, loan growth has moderated across all income categories between Sep 2023 and Sep 2024, with a sharper deceleration in the group with less than ₹5 lakh annual income. The ₹5 lakh - ₹15 lakh income category had the largest share of outstanding loans as of end-Sep 2024.

Asset Quality: Banks’ retail loan quality has remained stable so far, with the GNPA ratio at 1.2% in September 2024. The SMA (1+2) ratio has also declined. The GNPA ratio for unsecured lending was marginally higher at 1.7%. An area of concern, however, is the sharp rise in write-offs, especially among private sector banks (PVBs).

[Special Mention Account (SMA) is a way to identify loans that are showing early signs of stress. SMA-0 = overdue <30 days, SMA-1 = 31-60 days, SMA-2 = 61-90 days, so on]

Multiple Loans: A notable percentage of customers availing consumption loans already have multiple existing loans, raising concerns about over-leveraging.

Nearly half of the borrowers availing CC & PL have another live retail loan outstanding, which are often high-ticket loans (i.e., housing and/or vehicle loan).

11% of borrowers originating a personal loan under ₹50,000 had an overdue personal loan, and over 60% of them had availed more than three loans during 2024-25 so far.

Is Small Beautiful: Low ticket sizes loans.

Small ticket personal loans (STPL) are unsecured loans with relatively low amounts (<50K), primarily catering to immediate financial needs. Borrowers with the ₹2.5-5 lakh annual income primarily take unsecured PL to fund their emergency needs OR for aspirations purpose.

FY21, was one of the worst phase for such loans. Delinquency (unpaid between 30-180 days) was 12.7%, up from 8.2% in the previous year and 4% in 2019, reflecting the impact of the COVID-19 pandemic on borrower repayment capacity.

In the recent report, CRIF - DLAI FinTech Barometer VOL II. We have some interesting pointers (image-followed by text).

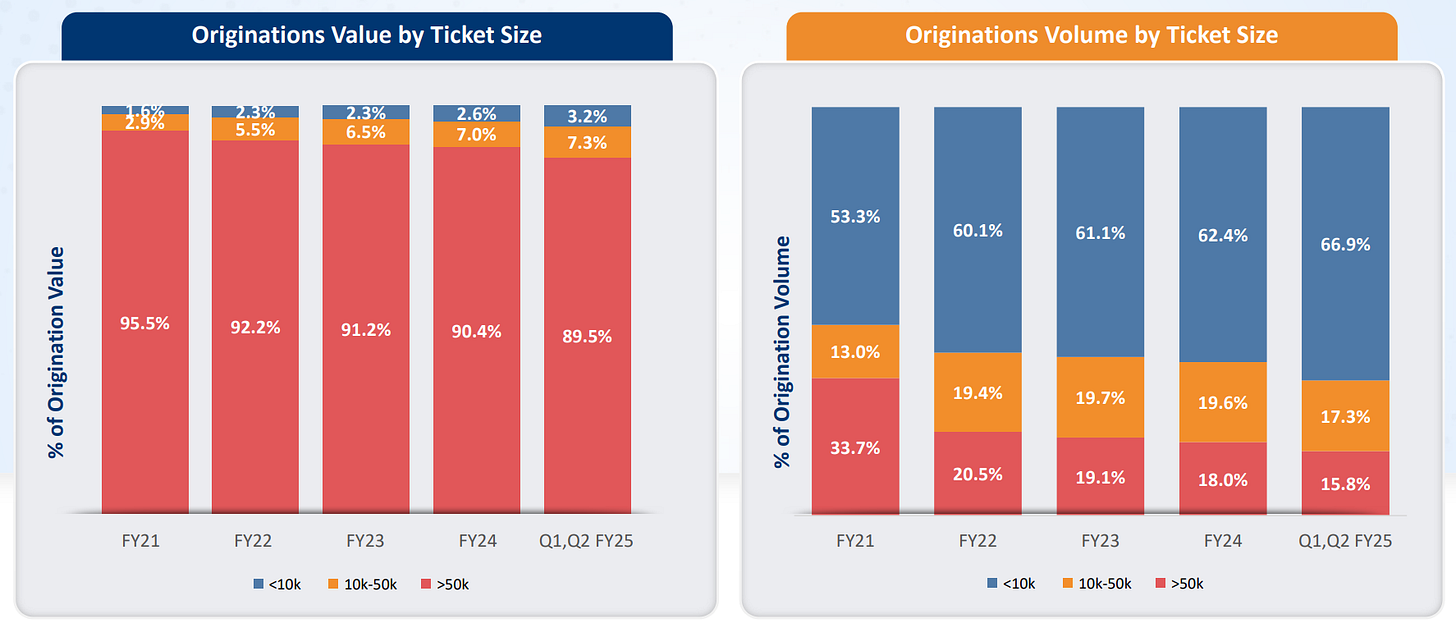

Growing Love for under 10K: We can see increasing Originations share (by Value & Volume) for loans with Ticket Size below Rs 10K. Is it because of the liquidity crunch? i.e. Give more loans of smaller ticket size to a larger base?

Origination Trends: There has been a decline in the growth of originations for personal loans under ₹10K in H1FY25 over H1FY24. NBFCs dominate the origination of personal loans with ticket sizes under ₹10K as well as between ₹10K-₹50K.

Score Transition: Borrower scores deteriorated for 22.7% of borrowers availing PL <₹10K in Dec 2023 compared to June 2023. For PL between ₹10K-₹50K, borrower scores deteriorated for 29.3% of borrowers in December 2023 compared to June 2023.

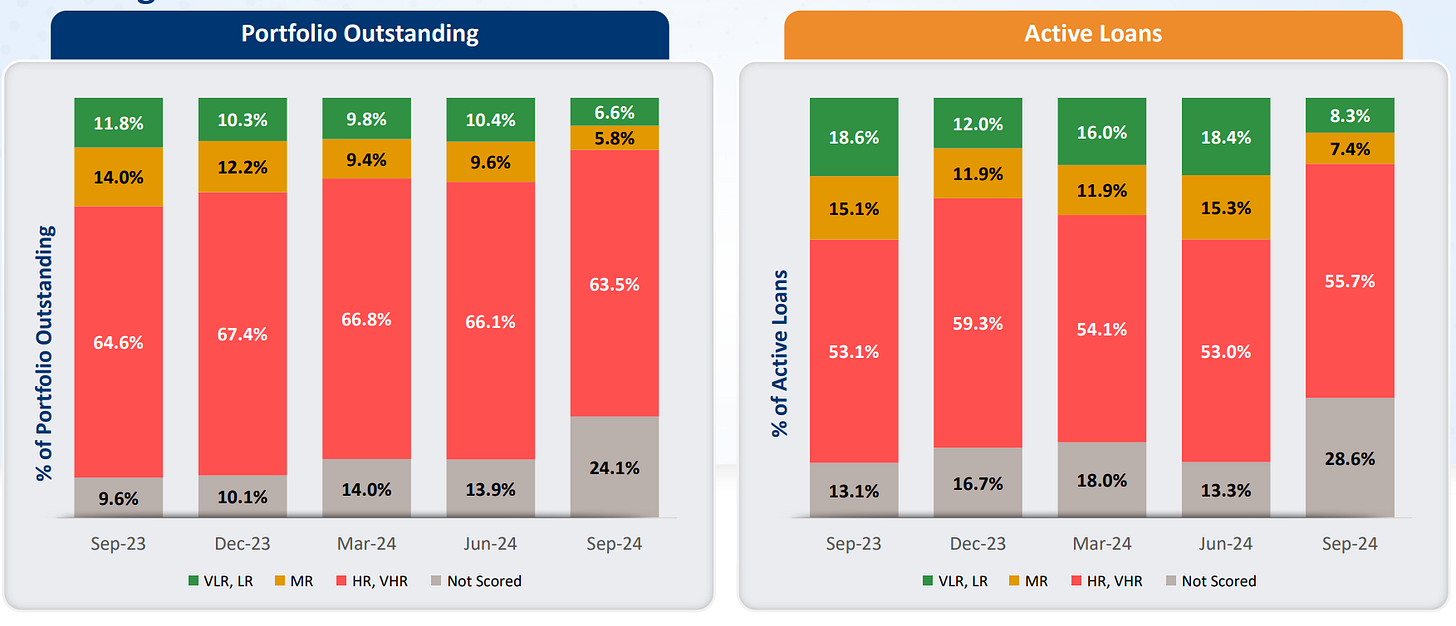

Risk Profile: Loans with "Not scored" and "Thin files" constitute a large portion (29% of the active loans) of this segment. It could be financial inclusion, or desire to have more margins (by charging more interest rate). This along with decline in Very Low (VLR), Low (LR) & Medium Risk(MR) Portfolio, is suggesting a kind of adverse selections, thus indicating higher risk. Is the high-interest for such loans are turning good customers away, and for growing the books, NBFCs are rather forced to choose among the bad?

Vintage Loan at Risk (LAR): focuses on loans originated within a particular period and measures the proportion of those loans that have become delinquent.

For personal loans less than ₹10K, the LAR 90+ peaks at 8.9% at 10 Months on Book (MOB).

For personal loans between ₹10K-₹50K, the LAR 90+ peaks at 6% at 10 MOB.

For personal loans greater than ₹50K, the LAR 90+ peaks at 3.6% at 34 MOB.

The largest gap in Vintage LAR 90+ between the <₹10K and ₹10K-₹50K loan categories occurs at 7 MOB, with a difference of 3.3%.

So, where are we heading?

Fintechs can argue that they are doing a large-benefit to the economy, i.e. Financial inclusion, and given tighter liquidity norms by RBI (in recent past), were limited with their choices.

While, RBI in their Financial Stability Reports of 24, was very upfront to mentioned that, “Delinquency of personal loans (8.2%) indicates declining standards of underwriting.”

So, we have to see the balance between these two ends: “Ability to grow customer base without increasing losses.”

Key consumer segment: Salaried professionals aged 22-45 are a core segment for financial products (esp. lending products) in India. Those earning salaries above ₹30,000 per month have the monetary bandwidth to opt for various financial products, including credit cards and loans. But most of this market is already crowded, given its lower base [See our related post on What Does it Mean to be Middle Class in India?]

Fintechs are also expanding into Tier-4 cities to tap into new customer bases, but this Untapped Market Potential, might not be right set for them from the point-of-view of collections efforts. Also the challenge of unsteady income and lack of documentation to support credit assessment, is often true for this segment.

Balancing innovation risks and profit margins is crucial for fintechs. Their sole right-to-win strategy lies in using alternative data for precise risk assessment and fraud prevention.