We often hear about economic figures like GDP, inflation, and unemployment rates in the news, but it can be hard to connect these numbers to our everyday experiences. So, How economic numbers fit into our daily lives?

Why Bother with GDP Data?

Investing without grasping the economy is like cooking a meal without knowing the ingredients you’re using, i.e. you’re missing critical pieces of the puzzle.

Investing without understanding economic factors—like inflation, interest rates, or market trends—leaves you vulnerable to surprises, and that’s where GDP comes in as a key indicator. The concept of GDP emerged in the 1930s, largely in response to the Great Depression. After the Bretton Woods Conference in 1944, GDP became the main tool for measuring a country's economy. Investors analyse GDP data for hints about the future direction of the economy. Here is why GDP matters:

Economic Pulse: GDP tells you whether the economy is growing, shrinking, or stagnating. A rising GDP often signals opportunity—businesses are thriving, jobs are increasing, and consumer spending is up, which can boost investments. A falling GDP, on the other hand, might warn of tougher times ahead, prompting caution.

Trend Spotting: It helps you see patterns over time. Consistent GDP growth could mean a stable environment for long-term investments, while erratic shifts might suggest volatility that affects markets and sectors differently. Analysing GDP components helps identify sources of strength and weakness in the economy.

Sector Clues: GDP breakdowns (like consumer spending, government investment, or exports) show which parts of the economy are driving growth—or dragging it down. For example, if consumer spending spikes, retail or tech stocks might benefit, but if exports tank, manufacturing could suffer.

Policy Impact: Central banks and governments use GDP to guide decisions on interest rates or stimulus. If GDP growth slows, they might cut rates to spur activity, which can lift asset prices—something investors need to anticipate. It also help in Inflation Monitoring.

How to use Data?

Dave Snowden, while working at IBM Global Services, began developing a decision-making framework. Along with Cynthia Kurtz, they published a seminal paper in 2000, "The new dynamics of strategy: Sense-making in a complex and complicated world," outlining the CYNEFIN core concepts.

"Cynefin" is a Welsh word that signifies the interconnectedness of factors in our environment and experiences

The CYNEFIN Framework helps us categorize data based on how clear the cause-and-effect relationships are and what kind of decision-making approach is needed. It includes five domains: Simple, Complicated, Complex, Chaotic, and Disorder.

For investing, GDP data is reliable and relevant but not simple or instantaneous. It requires skill to unpack its meaning and apply it effectively. That’s why it belongs in the Complicated Domain of the CYNEFIN Framework—solid data that rewards analysis rather than reflex.

Two widely used approaches for computing GDP are the Gross Value Added (GVA) approach and the Expenditure Approach.

The GVA approach calculates GDP by focusing on the production side of the economy. It sums the value added by each sector (e.g., agriculture, manufacturing, services) during the production process. Value added is defined as the difference between the value of a sector’s output (the goods or services it produces) and the value of its intermediate inputs (the goods and services it purchases from other sectors to use in production).

The Expenditure Approach calculates GDP by focusing on the spending side of the economy. So, here:

GDP = Private Final Consumption Expenditure (PFCE)+ Government Final Consumption Expenditure (GFCE)+ Gross Fixed Capital Formation (GFCF) + Changes in Stocks (CIS) + Valuables + Exports - Imports

India's GDP: Where Is It Headed?

Once hailed as the world's fastest-growing major economy, our GDP growth has lost some momentum. As of early 2025, India’s GDP growth has hit a speed bump—clocking 5.4% in Q3 2024 (July-September), a seven-quarter low. The shine of being the "fastest-growing major economy" (a title it held with 6.8-7% growth in recent years) is dimming slightly (for now).

Real GDP is estimated to grow by 6.2% in Q3 of FY 2024-25. Growth rate in Nominal GDP for Q3 of FY 2024-25 has been estimated at 9.9%. In Q3 FY25, India's Gross Domestic Product (GDP) experienced a growth of 6.2% year-on-year (YoY), surpassing the previous quarter's growth of 5.6% YoY, which was revised upwards from an initial 5.4% YoY. This improvement was largely due to increased government and private final consumption expenditure (GFCE and PFCE), as well as reduced drag from net exports.

Key Figures from the SAE

The Second Advance Estimates (SAE) of GDP for FY24-25 (April 2024 - March 2025) was recently released by the National Statistical Office (NSO). These estimates refine the First Advance Estimates (FAE) from January 7, 2025. Here's a detailed sectoral breakdown:

Part1: Gross Value Added (GVA) approach

Overall GVA Growth: Estimated to grow by 6.4% in FY25.

Q3 FY25 GVA Growth: 6.2%.

Primary Sector

FY25 Growth: 4.6%.

Q3 FY25 Growth: 3.6%.

Components:

Agriculture, Livestock, Forestry & Fishing: FY25 growth of 4.6% and Q3 FY25 growth of 5.6%.

Mining & Quarrying: FY25 growth of 2.8% and Q3 FY25 growth of 1.4%.

Secondary Sector

FY25 Growth: 5.8%.

Q3 FY25 Growth: 4.8%.

Components:

Manufacturing: FY25 growth of 4.3% and Q3 FY25 growth of 3.5%.

Electricity, Gas, Water Supply & Other Utility Services: FY25 growth of 6.0% and Q3 FY25 growth of 5.1%.

Construction: FY25 growth of 8.6% and Q3 FY25 growth of 7.0%.

Tertiary Sector

FY25 Growth: 7.3%.

Q3 FY25 Growth: 7.4%.

Components:

Trade, Hotels, Transport, Communication & Services related to Broadcasting: FY25 growth of 6.4% and Q3 FY25 growth of 6.7%.

Financial, Real Estate & Professional Services: FY25 growth of 7.2% and Q3 FY25 growth of 7.2%.

Public Administration, Defence & Other Services: FY25 growth of 8.8% and Q3 FY25 growth of 8.8%.

Nominal GVA at Basic Prices (at Current Prices)

Overall GVA Growth: Estimated to grow by 9.5% in FY25.

Q3 FY25 GVA Growth: 9.0%.

Primary Sector

FY25 Growth: 10.1%.

Q3 FY25 Growth: 5.2%.

Components:

Agriculture, Livestock, Forestry & Fishing: FY25 growth of 11.0% and Q3 FY25 growth of 5.2%.

Mining & Quarrying: FY25 growth of 2.1% and Q3 FY25 growth of 1.4%.

Secondary Sector

FY25 Growth: 6.6%.

Q3 FY25 Growth: 5.6%.

Components:

Manufacturing: FY25 growth of 5.8% and Q3 FY25 growth of 3.5%.

Electricity, Gas, Water Supply & Other Utility Services: FY25 growth of 3.9% and Q3 FY25 growth of 5.1%.

Construction: FY25 growth of 8.6% and Q3 FY25 growth of 7.0%.

Tertiary Sector

FY25 Growth: 10.7%.

Q3 FY25 Growth: 7.4%.

Components:

Trade, Hotels, Transport, Communication & Services related to Broadcasting: FY25 growth of 9.0% and Q3 FY25 growth of 6.7%.

Financial, Real Estate & Professional Services: FY25 growth of 10.2% and Q3 FY25 growth of 7.2%.

Public Administration, Defence & Other Services: FY25 growth of 13.4% and Q3 FY25 growth of 8.8%.

Additional Insights

Manufacturing Slowdown: A noticeable deceleration in manufacturing growth from 12.3% in FY24 to 4.3% in FY25.

Agriculture Boost: Agriculture shows improved growth, driven by a decent monsoon.

Services Resilience: The services sector remains robust, particularly in trade, hotels, transport, communication, and financial services.

Construction Stability: Construction maintains strong growth, although slightly reduced from the previous year.

Part2: Expenditure Approach:

PFCE: Increased to 6.9% in Q3 FY25 from 5.9% in Q2 FY25.

GFCE: Increased to 8.3% from 3.8%.

GFCF: Eased marginally to 5.7% from 5.8%.

Net Exports: The drag from net exports narrowed significantly.

Additional Insights

Gross Fixed Capital Formation (GFCF): Investment growth slowed to 6.5% (from FAE’s 6.4%), down from 9% in FY23-24, hinting at cautious private sector expansion.

Private Consumption: Estimated at 5.8% growth, the slowest in two decades outside the pandemic, underscoring urban demand softness.

Government Spending: Up 9.1%, a key prop as fiscal stimulus ramps up post-election.

Net Exports: A drag, with exports growing 2-3% but imports outpacing due to oil and gold.

So, what’s the conclusion?

Economic Health: A 6.5% growth rate sustains economic momentum but doesn’t generate enough jobs to absorb this influx, especially in high-quality, formal sectors. Studies (e.g., by economists like Arvind Panagariya) suggest 7-8% growth is needed to create 8-10 million jobs yearly, reducing underemployment and reliance on agriculture (still ~42% of the workforce).

Can Will India Hit $5 Trillion? At 6.5% real growth, nominal GDP might hit only ~$4.8 trillion by 2027-28, missing the mark unless inflation spikes or the rupee depreciates significantly (both risky scenarios).

Challenges to Achieving 7-8%: Growth above 7% requires investment-to-GDP ratio of 35-40% (currently ~32-33%). Private-sector capex remains tepid despite government nudges. Trade slowdowns, commodity price volatility, and geopolitical tensions (e.g., Russia-Ukraine, Middle East) cap export growth.

Global Role: Can India double its export share by 2030 (to $1 trillion in merchandise)? Diversifying beyond IT and pharma into textiles, electronics, and green tech is critical, especially amid global supply chain shifts.

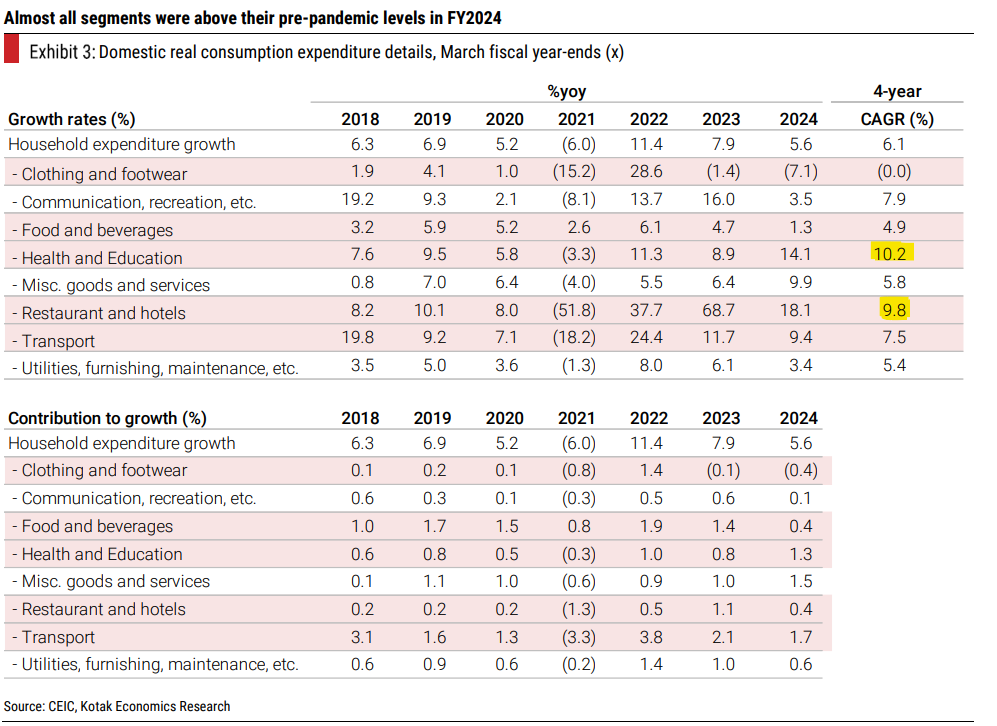

Consumption Patterns: There's a notable rise in PFCE, which signals greater consumer spending. Specifically, the YoY growth in PFCE rose to 6.9% in Q3 FY25 from 5.9% in Q2 FY25. A key driver of private consumption is the increased spending on healthcare and services like hotels and education, reflecting changing consumer priorities and increased disposable income.

But, is GDP "be-all and end-all." data/tool?

The GDP increases each time money is exchanged. This means that even unproductive or even harmful activities can contribute to GDP if they involve monetary transactions. For example, increased spending on healthcare due to rising pollution levels OR bad roads would still contribute to GDP growth.

“The real estate brokers, the engineers itching to build paved roads, have their hearts set on transforming the desert into a replica of greater Los Angeles. Growth for the sake of growth is the ideology of the cancer cell.” - Edward Abbey