Jan Aushadhi and Generics: Is this a Game Changer for Affordable Healthcare?

The Growing Power of Generic Medicines in India. Too Big to Ignore?

Pick any strategy book, and you will most liking get a gyaan like this: "Success is a moving target. What brought us here won't take us there." It’s a truism you’ll find in classics like Jim Collins’ Good to Great or Clayton Christensen’s The Innovator’s Dilemma—a reminder that clinging to past playbooks can leave you stranded as markets shift.

The Indian pharmaceutical industry is globally recognised as the "Pharmacy of the World" due to its significant production and supply of affordable generic medicines and low-cost vaccines. India ranks third globally in pharmaceutical production by volume and is known for its generic medicines. So, what next for our pharma companies?

"The strategy that won the last battle won't win the next war. Adapt or perish."

India manufactures about 60,000 different generic brands across 60 therapeutic categories, accounting for 20% of the global supply of generics.

Indian Pharma’s Moving Target

The top 50 players—Sun Pharma, Divi’s, Cipla, Torrent, Mankind, etc.—dominate by revenue, holding 60-70% of the IPM’s value. Below them, hundreds of small, micro, and nano-sized firms (estimated 3,000-10,000 total pharma companies) operate, often focusing on generics, contract manufacturing (CMOs), or regional markets. These smaller players contribute 40-45% of volume but a much smaller value share due to low pricing and limited scale.

Historically, the Indian pharmaceutical industry has heavily reliant on branded generics, which have constituted a significant portion of the market. This was built on doctor trust, higher margins, and a fragmented pharmacy market.

Over the period of 2019-2023, the Indian Pharmaceutical Market (IPM) witnessed a CAGR of 9.1%, largely driven by Branded Generics. The IPM is expected to continue growing at a CAGR of 9.6% to reach ₹4,60,000 crores by 2030.

Branded generics have historically dominated the IPM. Companies like Alkem, Cipla, and Sun Pharma have significant portfolios of branded generics across various therapeutic areas.

Mankind Pharma has developed numerous mega brand families within the branded generics segment, with 22 brands bringing in >₹1 bn in sales compared to 7 in FY20. Torrent Pharma has also scaled up its branded generics business, which constituted approximately 73% of its FY23 sales.

But, this landscape is evolving due to factors such as government initiatives promoting affordability and increasing price sensitivity among consumers.

Branded Generics, Trade Generics, and Generic Generics.

The pharmaceutical market in India categorises generic drugs into three types:

Branded Generics: These are generic drugs marketed using a brand name and promoted through medical representatives. In 2023, branded generics accounted for ~ 85% of the IPM by value, they offered more lucrative profit margins compared to their unbranded counterparts. However, recent growth in the branded IPM has been sub-par in the past 2.5-3 years, primarily due to subdued volumes.

Trade Generics: These are branded medicines not promoted to doctors but provided to channel players like retailers and stockists at higher margins to drive sales. Trade Generics held ~ 10% of the IPM by value in 2023.

Generic Generics: These are unbranded drugs sold under their chemical or generic name and are often priced lower than their branded counterparts. The Jan Aushadhi scheme primarily focuses on providing Generic Generics. This segment held 0.5% of the market share in 2023 and is expected to reach 1.1% by 2030, driven by government initiatives like Jan Aushadhi stores.

Trade Generics (TGx): The Silent Volume Giant

What They Are: Trade generics are branded medicines sold directly to distributors and retailers without the heavy marketing or doctor-prescription push typical of traditional branded generics. They’re priced 50-60% lower than branded counterparts, targeting cost-conscious buyers. Mankind, Torrent, and Dr. Reddy's have increasingly focused on the trade generics segment in recent years. Cipla and Alkem have significant presence in this space, with annual trade generics sales of approximately Rs 22 bn and Rs 15 bn respectively.

Market Impact: Growing at 14-15% annually, trade generics now account for 20-25% of the IPM by value and 40-45% by volume, per industry insights. It was valued at ₹24,000 crores in 2023 and has grown by 14.9% in the period 2019-2023. The top four therapy areas in the trade generics segment are primarily from the acute segment, with Anti-Infectives and Pain/Analgesics contributing significantly to sales.

Why It’s a Threat: Trade generics bypass the doctor-driven prescription model that branded pharma relies on, appealing directly to pharmacies and patients. It is projected to grow at a CAGR of 16% by 2030. This growth is driven by increasing demand from Channel Partners due to growing retail competition and margin pressures. Additionally, post-COVID-19, several Indian pharma companies have introduced their non-core therapy areas into the TGx market, increasing pharmacies' confidence in substituting branded products.

Generic Generics: The Government’s Affordable Medicine Push

What It Is: Generic Generics are unbranded drugs sold without a specific brand name, often priced lower than their branded counterparts. They contain the same active pharmaceutical ingredient (API) as branded drugs. These medicines, sourced from WHO-GMP-certified manufacturers and public-sector undertakings, are sold through dedicated Jan Aushadhi Kendras (JAKs).

Scale and Growth: The segment of Generic Generics stood at ₹1,200 crores in 2023 and is expected to reach around ₹5,250 crores by 2030, with an impressive projected growth rate (CAGR) of 23%. As of March 2025, over 14,000 JAKs operate nationwide, up from 80 in 2014, with a target of 25,000 by FY27. Sales have soared from ₹7.29 crore in 2014 to ₹1,470 crore in 2024—a 20,063% jump.

Why It’s a Threat: JAKs undercut branded generics on price while offering bioequivalent quality (1,451 drugs and 240 surgical items in the basket). This erodes the premium pricing power of branded pharma, especially for chronic disease drugs (e.g., pantoprazole at ₹22 vs. ₹170 for Pan-40). The government’s aggressive expansion and awareness campaigns amplify its reach, shifting consumer trust toward generics.

Jan Aushadhi Yojana: The Unbranded Challenger

Launched in November 2008 under the UPA government and rebranded in 2015 as Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), Jan Aushadhi aims to make quality, unbranded generics accessible at rock-bottom prices. It’s a direct jab at branded generics’ pricing, targeting India’s 60%+ population struggling with healthcare costs—where branded drugs often carry 80-90% markups over production costs. By 2014, only 80 JAKs were operational across India, a mere drop against the country’s 7-8 lakh pharmacies. Sales were negligible— ₹ 7.29 crore annually by 2014—hampered by limited awareness, poor supply chains, and a lack of political push.

Revival and Expansion (2015-2024)

The government established the Pharmaceuticals and Medical Devices Bureau of India (PMBI) to streamline procurement, supply, and marketing, partnering with PSUs and private GMP-compliant manufacturers.

As of 31st March 2024, 11,261 PMBJKs had been opened across India. This surpassed the initial target of 10,500 Kendras by March 2025 and a revised target of 10,000 by December 2023, which was achieved ahead of schedule. Looking back at the progression:

In 2017-18, there were 2226 functional Kendras.

By 2018-19, this number had increased to 5140 cumulatively.

2019-20 saw a further rise to 6306 cumulative Kendras.

In 2020-21, the cumulative number reached 7557.

By 2021-22, there were 8610 functional Kendras.

As of 31st December 2022, the number stood at 8998.

During the financial year 2023-24, 1957 new Kendras were added, bringing the total to 11,261 by 31st March 2024.

The growth has continued into the current financial year, with 3059 Kendras added as of 30th November 2024, taking the total to 14,320.

For the first 11 months of FY2025 (up to November 2024), sales have already reached ₹ 1255 crore, or Rs 17.6 billion. The government is aiming for total sales of Rs 20 billion in FY2025E.

The Promise of Jan Aushadhi: Will it Reach its Full Potential?

There is a famous African Proverb- "Smooth seas do not make skillful sailors." So, what’s life without challenges. In same way, The Promise of JAKs will have to navigate these challenges:

Financial Viability of Kendras: A significant challenge is ensuring the financial sustainability of the Jan Aushadhi Kendras, particularly in Tier 3 and 4 cities. Owners often rely on ₹ 5 lakh subsidies (₹ 2.5 lakh grant, ₹ 2.5 lakh credit). Many Kendras currently operate at a loss and resort to selling trade generics to become viable. This can potentially dilute the core objective of promoting unbranded generic medicines.

Supply Chain Bottlenecks: Kendras often stock just 500-600 of 1,965 drugs, leading to frequent shortages (e.g., metformin or amlodipine unavailable). Maintaining a robust and efficient supply chain to ensure the continuous availability of medicines at all Kendras is a critical challenge.

Public Perception and Acceptance of Generic Medicines: Overcoming the Perception of “cheap = low quality”. Continuous efforts are needed to build public confidence and awareness regarding the quality and efficacy of Jan Aushadhi medicines through education and publicity.

Quality Control: Ensuring rigorous quality control of generic medicines available at Jan Aushadhi Kendras is essential for building and maintaining trust among consumers. This necessitates stringent quality checks at all stages of procurement and distribution.

So, what’s the conclusion?

The government has set ambitious targets for the further expansion of the Jan Aushadhi Yojana by 2027, indicating a strong commitment to promoting affordable healthcare. This will have two bigger impacts:

Impact on Household Savings:

Reach: The PMBJP has had a significant impact on making medicines affordable. With 55 crore indirect beneficiaries (per Ayushman Bharat synergies) and 14,000+ Kendras, savings likely touch 10-15% of India’s 140 crore population—rural and low-income households most impacted.

In FY2024, the program is estimated to have resulted in savings of approximately ₹ 73.5 billion for Indian citizens, which is five times PMBJP's sales. Over the last ten years, the total savings are estimated to be over ₹ 300 billion, or Rs. 30,000 crore.

Redirected Expenditure: Savings shift as additional consumer spending on food, education, durables or rural FMCG. Along with Ayushman Bharat, it can have Multiplier effect.

Rural Economy Boost: 60% of JAKs in rural/semi-urban areas shift savings to agrarian pockets. It will also have little upstick in Job Creation and Investment, you need 2-3 folks per store.

Impact on the Pharmaceutical Market:

Limited Scale vs. Pharmacy Network: JAKs’ 14,000+ stores (25,000 by 2027) are a fraction—3-4%—of India’s 7-8 lakh pharmacies, per FADA-like retail logic. Even at 40,000, they’d hit 5-6%, dwarfed by private chemists’ reach. Also, urban patients favor nearby pharmacies.

Competition from Trade Generics: Trade generics outmaneuver JAKs with broader reach and flexibility, as pharmacies favor trade generics’ profitability and availability—JAKs’ rigid sourcing (1,000 CMOs) can’t compete with trade’s broader pool.

Competitive Dynamics: Cipla is one of largest player in the trade generics space. More recently, companies like Mankind, Torrent, and Dr. Reddy's have also started their own trade generics divisions.

Focus on Specialty Drugs and Complex Generics: Alongside trade generics, there's a clear trend among Indian pharmaceutical companies, including Sun Pharma, Cipla, and Dr. Reddy’s, to focus on specialty drugs, complex generics (like biosimilars and biologics), and novel drug development. This is seen as a way to move up the value chain and capture a larger share of the global market, where innovation and complex generics command higher market value.

Market Share Erosion

While branded generics still (and will continue to) dominate by value, the increasing adoption of lower-priced generics through Jan Aushadhi and other channels is exerting pressure on the branded segment's growth.

This significant expansion of Jan Aushadhi stores, along with trade generics and private generic pharmacy chains, is expected to have a continued impact on the branded generics segment of the Indian Pharmaceutical Market (IPM).

It is estimated by Kotak Equities that these alternate channels will cause an annual dent of 120-160 basis points on the branded IPM's growth at least until FY2028E.

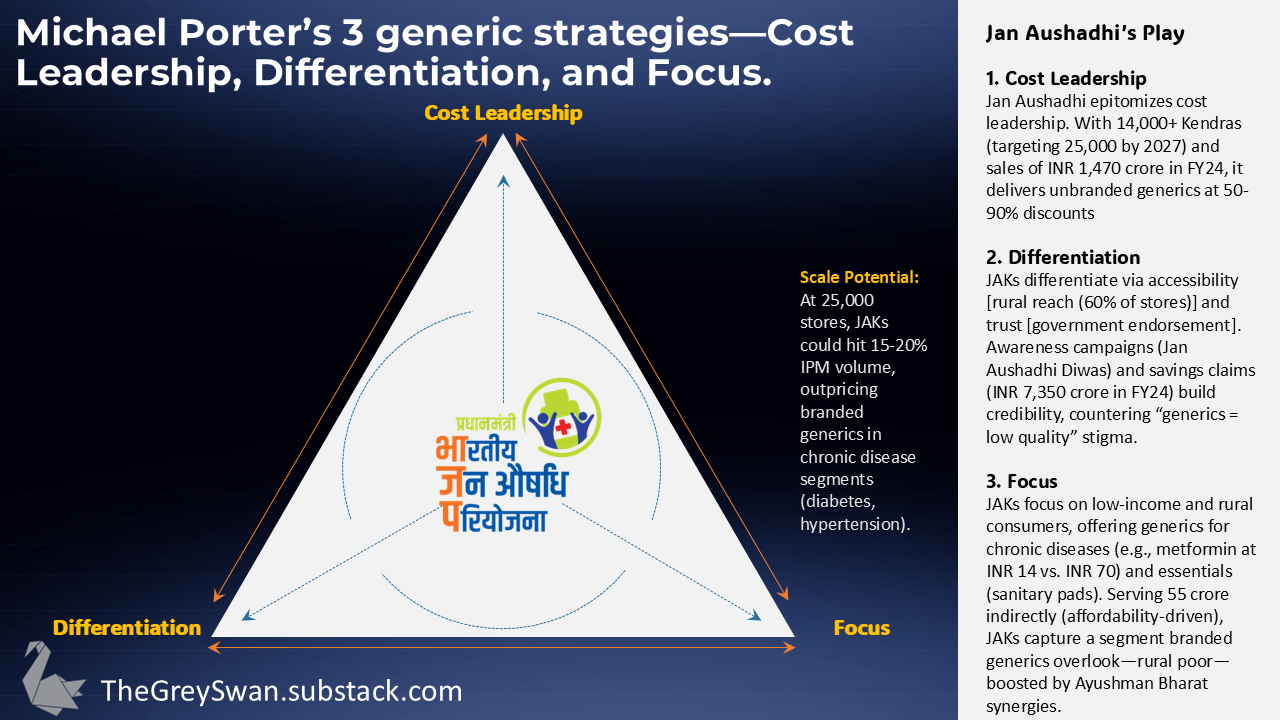

Michael Porter, a renowned professor at Harvard Business School, identified Cost Leadership, Differentiation and Focus, as the generic strategies that businesses can use to achieve a competitive advantage in their industry. So, if he is engaged by NITI Aayog, the key deck would be like this.