Maximum Constraint

Outcomes come from narrowing the game: batters, founders, investors, and the discipline of forbidding options.

Like most Indians, I love cricket. Just that I prefer reading it—especially the ball-by-ball rhythm on Cricinfo—rather than watching it live. A few days back, while scrolling through a post, the seed for this essay arrived. It was strong enough to break my self-imposed hiatus on posting.

Coincidentally, the last time I used a cricket analogy at GreySwan, it was from another Sharma. He asked:

“Am I breaking a stone to break a stone? Or am I breaking a stone to build a building?” Read more

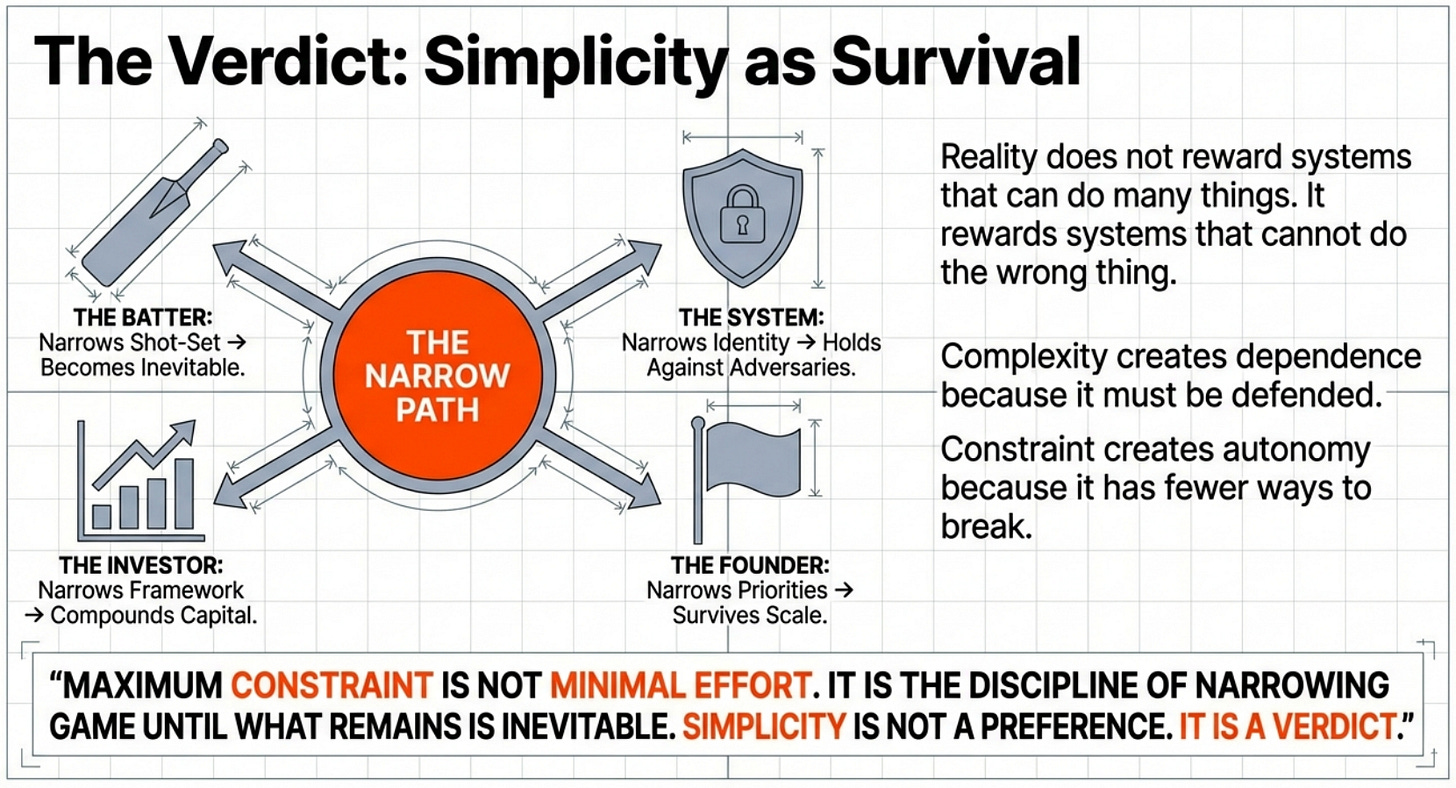

Purpose matters. Constraint matters. And your direction matters. That is the hidden architecture of simplicity.

“I don’t have a lot of shots.”

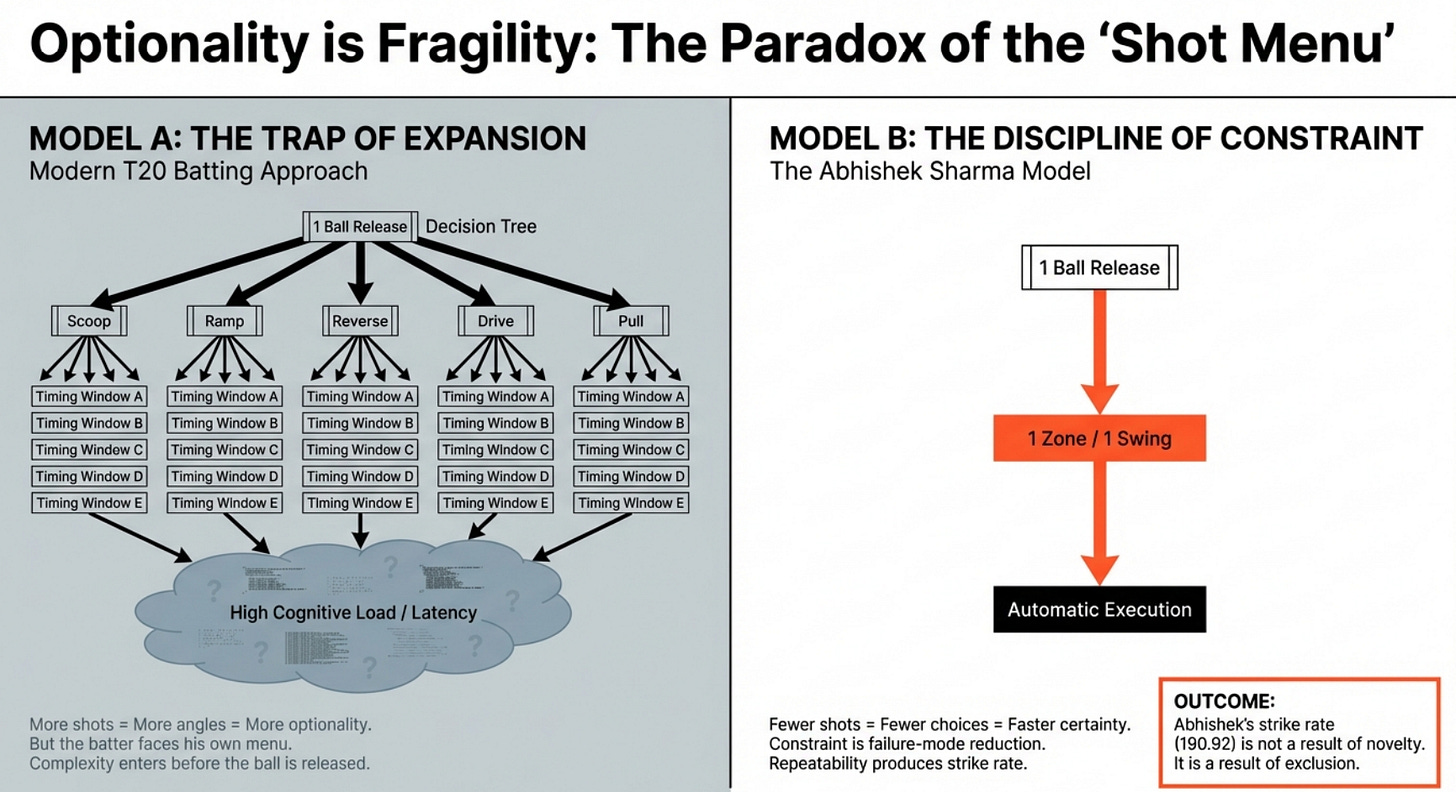

That was Abhishek Sharma after scoring 84 off 35 balls against New Zealand in the first T20I in Nagpur. By modern T20 standards, his shot selection is almost old-fashioned. Yet his T20I strike rate is 190.92. Modern T20 batting is built on expansion. The assumption is simple:

More shots = More angles = More innovation = More optionality.

If you increase the shot-set, you increase scoring opportunities.

But optionality has a cost. The batter is not just facing the bowler.

He is facing his own shot menu. Complexity enters before the ball is even released.

Abhishek does the opposite. He constrains. These are my zones. These are my swings. These are the strokes that will survive pressure. Everything else is forbidden. This is not limitation. This is failure-mode reduction. Fewer shots means fewer choices. Fewer choices means faster certainty. Certainty is what produces speed. Repeatability is what produces strike rate.

Constraint is not minimalism. Constraint is compounding.

Simplicity is not what remains when effort is removed. It is what remains when freedom is removed.

Now take investing.

Most investors expand frameworks endlessly. Valuation stories. Growth narratives. Macro overlays. Sector cycles. Sentiment explanations. Each layer feels sophisticated. Each layer multiplies interpretation. Markets punish interpretation. Not immediately. But structurally.

Over long horizons, outcomes compress into a single constraint: ROCE.

Return on capital is the batting technique of investing. The clean swing that survives conditions. It binds profitability, reinvestment quality, competitive advantage into one requirement. High ROCE businesses do not need new stories every quarter. They do not require narrative oxygen. The economics are the story.

Low ROCE businesses survive only through explanation. Cheap capital. Favorable cycles. Constant reinvention. Optionality disguised as strategy.

ROCE is not a perfect metric. It is sufficient. Sufficiency beats completeness when reality is noisy.

High ROCE is Abhishek’s limited shot-set: narrow, repeatable, binding.

And the pattern extends into my own domain: fraud prevention.

Digital fraud is where complexity is most seductive. Most of the Risk Mangers often build like they are designing a Grand Wedding Pandal. They layer silk over bamboo, add intricate lighting, complex floral arrangements, and heavy ornaments. It looks sophisticated, but it’s fragile.

When you rely on “sophisticated” risk engines, you are playing in the adversary’s playground. They want you to use complex models because models require assumptions, and assumptions are where they hide.

The most effective control is the “primitive” one that collapses the space in which the thief can exist: Triangulation and Vintage.

Identity Vintage: If a phone number and email address have existed together for 8 years, the probability of fraud drops to near-zero. Why? Because a fraudster can create 1000 identities today, but they cannot create an identity with a 10-year-old history today.

Triangulation: Does this digital identity exist across unrelated ecosystems (Banking, E-commerce, Social)?

Time is the only resource a fraudster cannot “hack.”

But then, Why We Choose the Pandal?

If a simple Pillar works, why do we keep building Pandals?

Why do we reach for complexity when simplicity is what actually works? Why do we keep adding shots, adding narratives, adding models—when the outcome so often comes from exclusion, not expansion?

The Founder’s Dilemma: Scale vs. Meaning

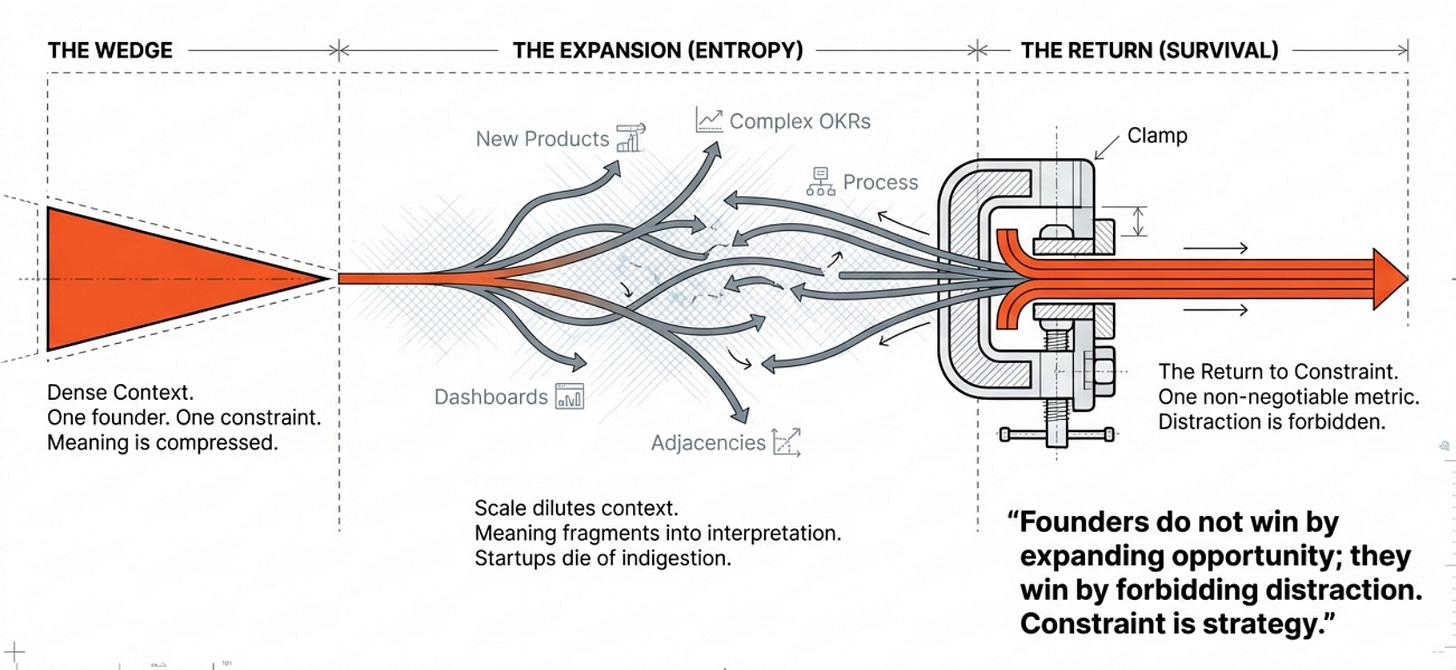

Every startup begins as a Wedge: one founder, one constraint, dense context. But as we scale, we enter the phase of Entropy (The Expansion).

We start adding “New Products,” “Complex OKRs,” and “Adjacencies.” But scale dilutes context. Meaning fragments into interpretation. Startups don't die of starvation; they die of indigestion.

Why Complexity is Psychologically Cheaper than Constraint

If the “Clamp” is what saves us, why do we keep expanding?

Complexity Postpones Commitment: Adding one more AI model or one more feature feels like “work,” but it’s actually a way to avoid making a hard decision. It allows you to believe the answer is still one layer away.

Social Legibility: A complex system is easier to defend in a boardroom than a simple “No.” Complexity puts “intelligence” on display; simplicity is often misread as a lack of effort.

The Fear of Being Wrong: We add narratives and layers because we fear admitting what actually matters. Complexity is comfortable because it distributes failure across an explanation. If the “model” fails, the model was wrong. If the “Constraint” fails, you were wrong.

Constraint, by contrast, is a decision. It shuts doors. It creates irreversibility. It forces trade-offs into the open.

Constraint is uncomfortable because it makes failure immediate and personal. Complexity is comfortable because it distributes failure across an explanation.

And that is why the discipline of maximum constraint is so rare: it requires the courage to narrow the game before the world narrows it for you.

The Constraint Engineering Doctrine

Constraint is not a tactical shortcut; it is a cognitive discipline. It is the courage to narrow the game yourself before the market, a fraudster, or a bad quarter narrows it for you.

Most failures are not technological—they are conceptual. They stem from ideas without edges, frameworks without hierarchy, and models without causal closure. Constraint engineering replaces “hope-based” complexity with three primitives:

1. Boundary: The Power of the Negative Space

Clarity requires that distinctions are actually distinct. Every idea is defined as much by what it is not as by what it is.

The Rule: If you haven’t shut any doors, you haven’t made a decision. A strategy that includes “everything” is just a list of wishes.

In Practice: Abhishek Sharma’s advantage isn’t his aggression; it is his exclusion. These are my shots; everything else is noise. In investing, the advantage isn’t prediction; it’s the refusal to buy “stories.” Capital must earn returns (ROCE). Everything else is a fairy tale.

2. Organization: Hierarchy Over Lists

To think is to organize. This is what separates a load-bearing framework from a simple list of features. Constraint is hierarchy imposed on reality—distinguishing what is binding from what is merely cosmetic.

The Rule: Treat all signals as equal, and you create a forest of weak indicators.

In Practice: A fraud system that weighs 50 variables (IP, browser, typing speed) is a “Pandal.” A system that identifies the Dominant Part—Identity Vintage—collapses that complexity into control.

3. Relationship: Causal Closure

To think is to connect. Every relationship is a chain of action and reaction: Pressure vs. Response, Optionality vs. Fragility, Constraint vs. Robustness.

The Rule: Complexity expands the space of interpretation. Interpretation expands the space for error. Error expands the need for “Management.”

In Practice: Every new “shot” or “feature” added to a system creates a new branch. More branches create more failure modes. Constraint engineering deliberately narrows these degrees of freedom until the outcome becomes repeatable.

The Conclusion: Encoding Intelligence

Constraint engineering is the art of encoding intelligence into the system before the moment of execution.

By the time the ball is bowled or the loan application is submitted, the “intelligence” is already done. The system no longer needs to “think” or “interpret” because the constraints have already dictated the outcome. You have narrowed the degrees of freedom until the outcome is repeatable.

The Power of Binding Truths

In a world of noise, we must rely on anchors that refuse to move:

ROCE is not just a metric. It is binding. It is the physics of capital that ignores the “growth story.”

Digital Vintage is not a mere filter. It is the only truth. It is a load-bearing reality that cannot be manufactured or “hacked” through .

Stripping Away to Reveal

The system stops requiring “intelligence” at the point of action because the strategy was built on exclusion.

“Simplicity is the essence of clarity, minimalism, and ease. It means stripping away the unnecessary to reveal what truly matters.” - by Dave Thomas, simplicity

Maximum constraint is not a lack of effort; it is the ultimate structure. Intelligence is not found in the layers we add, but in the options we have the courage to forbid.

The exclusion comes first. The outcome comes later.

The Abhishek Sharma batting analogy is a great illustration of simplicity, clarity and therefore flow. Thanks