Narrower Rallies ahead: a travel tale and a stock picking framework

Understanding the current market regime and stock earnings predictability is crucial to any market strategist.

A Travel Tale.

I paid my second trip to Hampi recently. Among my favorite attractions are the restaurants with a cool, young and relaxed vibe, overlooking paddy fields overrun with monkeys — that sort of thing. But it turns out a Supreme Court order had all my favorite restaurants in 'Hippie Island' recently demolished. So disappointed, I set out looking for the next chill place in the main Hampi bazaar : on Google Maps (which exists to deceive !).

My partner and I find that the German Bakery, which had supposedly relocated from Hippie Island to the main bazaar had once again ceased to exist. All we found of the other places were empty, boarded up restaurants in the narrow lanes of the cramped village that surrounds the Bazaar.

Disappointed, hot and hungry, we resigned on the more popular alternative. A restaurant called Mango Tree, which is on every tourist's lip. Mango Tree. Mango Tree... its so talked about, it could be a UNESCO monument in itself. It turned out there was a reason.

The place unlike German Bakery, had a long waiting line, and when our chance came we found that while it did not overlook any quaint paddy fields — it copied the slow and chill vibe of its erstwhile competition in Hippy Island. Same layout. Even similar music....

Tables were reserved well in advance and the shoe racks outside were loaded to their wooden seams. Inside, families, groups of tourists and backpackers all enjoyed a variety of meals at near-Bangalore prices. It had captured the whole market and then, raised prices.

So what is the Market lesson in all of this ?

Over the past few years, a very similar phenomenon has played out in the spectrum of Indian businesses, from small factory shops to MNCs and large domestic conglomerates.

Just like the shutting down of Hippy Island, the effect of demonetization, the imposition of GST and finally the shock of the pandemic has concentrated pricing power and market share in the hands of a few larger players versus the multitudes.

Amul, now serves processed milk, farm to table and the entire array of its value-added products, crowding out many of its smaller competitors and capturing their market share. This gain in market share was achieved by expanding procurement, product development, marketing and distribution, where its competitors did not have sufficient staying power to protect their market share through the pandemic. Bear in mind that milk is perishable good where local procurement offers significant cost advantages to incumbents.

The situation is even direr for smaller players in soft commodities like edible oils, where larger companies like Ruchi Soya, Adani Wilmar (which is to IPO soon) have captured a larger share of the market. The same is seen in sectors like building materials and textiles which had a large portion of unorganized players. Even capital intensive sectors like real estate and metals have seen significant consolidation in the past few years, in the favor of larger more established incumbents.

Listed companies have a certain amount of survivorship bias. It takes (used to take) a history of profitability and meeting of a threshold of governance and disclosure requirements for a company to list in India. Under the hood, the impact of the shift from unorganized to the organized sector has impacted MSME, SME units not listed on the bourses for a host of reasons:-

Costs: GST compliance costs and taxation have raised prices for a lot of suppliers to small factory shops. Many of these shops relying on the raw material from unorganized sector, were already running on wafer-thin margins like processing of textiles, basic chemicals or building materials for downstream industries. With the added tax, they were not able to pass on the increase in raw material prices leading to accumulating losses, as a result of which they had to liquidate and shut down the business.

Leverage: The cost of capital in India is higher than 13% for smaller companies as banks are hesitant to lend to small companies without a seasoned relationship or established credit quality. This puts brakes on any expansion plans to respond to market or competition. To make the situation worse, large companies with access to cheaper capital have announced capex plans to capture market share from small companies.

Demand: The pandemic caused a sudden downward shock in demand, leading to rising inventories. Smaller companies were not able to meet their fixed costs, unlike larger companies that had access to short term and working capital financing.

The capital market of India is in a state of flux

While early growth and small-sized companies have suffered in old economy sectors like soft commodities, textiles, dairy and building materials, the rule does not extend to new-age companies backed by Venture Capital. In fact, the recovery in new-age companies after the Covid crash in March 2020 has been steeper than in mature companies. This has been a worldwide phenomenon that valuation guru Aswath Damodaran attributes to the resilience and higher risk appetite of Venture Risk Capital chasing these early growth new-age businesses.

However old economy companies or cyclicals with relatively stable (read: slow-growing) business models. These companies still dominate the Indian Capital Markets and they do not, in general, enjoy the capital backstop or valuations premiums from intangible and scalable growth assets that new-age companies benefit from.

Are you looking for a great stock to buy? If so, how do you pick the best one?

When selecting stocks there are a number of factors that can affect your stock market success.

A framework: to pick winners.

Now that we have spoken of the broader trend towards unorganized and smaller players in old economy sectors losing market share to the organized sector, let us define a framework to identify such companies in the stock markets. We are looking for :

Established market leaders or companies forming mini-monopolies without necessarily being in the news

Companies with good medium-term historical return profiles

Companies that are not in the early growth stage

One screen to look for such companies is :

Average 3-year Return on Capital Employed > 20% AND

Latest Return on Capital Employed > 35% AND

Average 5 year Sales growth > 5% AND

Market Capitalization > 10000 crores

Below is one such company, a leader in the paints industry and a household brand, which meets this criterion

What is the rationale behind such a framework? Essentially, it boils down to a few things -

Return on Capital Employment is a measure of a company's efficiency in compounding returns into the company, i.e. invested capital, which is a measure of capital the company requires to operate - or the capital assets minus the short term debt. By virtue of superior access to the market and resources, a larger company will utilize its capital assets and working capital more efficiently.

Sales growth is expected from a company gaining market share in a growing industry. Good companies gain market share also in bad times but given the cyclical nature of industries and the large base of big companies, for prudence, it would make sense to screen for companies growing sales steadily over a large horizon (for e.g. 5 years).

Note that this is a 'catch all' framework and does not screen for an increase in pricing and profitability, as a company could gain and defend market share by cutting prices, as Tata companies did through the past few years, or it could also capitalize on its prominence by raising prices, depending on where in the economic, market, maturity or industry cycle the company is at a point in time.

Apart from the ROCE and Sales Growth based framework defined above, one can also follow the framework defined by William O' Neil for identifying what he called Market Leader stocks

71% had >50% YOY EPS growth in the most recent quarter

86% had >40% sales growth in the most recent quarter

Average ROE was 28%

Time from breakout to peak averages 14-18 months (i.e. time from breaking out of last channel or high, to making a new all-time high)

Narrower Rallies Ahead: Implications for Market Direction

As people queue up for the Mango Tree restaurants and as the Germany Bakeries get boarded up, the stock market will react in peculiar ways.

The current rally which has had unprecedented breadth since April 2020 may lose its breadth, where breadth is defined as the ratio of total stocks advancing to total stocks declining in price.

As the divergence in market share and earnings becomes known to the stock market, this ratio will drop, when hot money chases the winners and exits the losers.

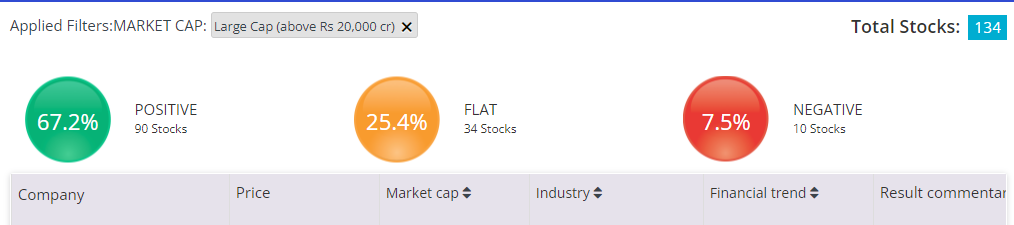

Large-cap stocks have in general more positive and sustained earnings than Micro cap stocks (defined as those with market cap <1000 cr.) and the gap has widened in the Sep 21 quarter.

A SNAPSHOT OF SEP 21 EARNINGS FOR THE MICROCAP SPACE — A LARGE NO OF FLAT RESULTS; SOURCE: MARKETSMOJO.COM

SEP 21 EARNINGS FOR THE LARGE CAPS — COMPARE THE NO OF POSITIVE EARNINGS V/S MICROCAPS; SOURCE: MARKETSMOJO.COM

Microcaps have sold off in expectation of the results and the Large Cap market cap / Small Cap market cap ratio has dipped from its high in July 2021. Small caps have got more inexpensive than large-caps as a result of the selling on a PE basis but this does not necessarily mean value has emerged broadly in the small-cap space. The more sustained selling could be indicative of future underperformance.

July to November 21 period has seen the relative strength of the Smallcap Index to the Nifty drop after a long period of gains; source: TradingView

Black Friday sale: A more recent sample.

Rumour about a new and potent Omnicron COVID variant spooked the market on 26 November, Black Friday to erase 6.5 lakh crores of Market Cap gains within hours of trading. Interestingly, the next Monday, recovery was led by the frontline index: NIFTY50 which showed greater relative strength compared to the NIFTY500, closing in green while lower market cap Indices like the SMALLCAP 100 closed over 2.5% down on Monday. Given the transitory fear and uncertainty caused by the variant, was this defensive Market behavior predictive of future risk aversion?

Perhaps not but as we move into choppier "risk-off" regimes, driven by fears of central bank tapering — money may indeed seek the safety of larger stocks, champions and index stalwarts for their relative lower betas and higher earnings predictability.

Playing the Market: How we would position ourselves.

Prudence would therefore advice positioning one's portfolio to hedge against the narrowing of the current rally. In terms of actionables, below is what I would do:

Restrict yourself to small and mid-cap stocks belonging to the NIFTY500 universe and exclude smaller capitalization stocks not belonging to the NIFTY500

Core portfolio to comprise of stocks with earnings history and meeting the framework criteria described above

Avoid cyclicals in the small-cap space, and screen out companies with negative free cash flows

Follow fund flows closely in and out of sectors and stocks. Generally in uncertain markets, institutional funds form a consensus on what sectors and stocks constitute safety, and you do not want to be other side of their consensus trade

Keep an eye out for volatility in the broader market. If the average 3-month volatility in the broader market remains elevated versus the Indices, re-balance a part of the portfolio into the frontline indices like NIFTY50

Summary and Conclusion

In one sentence, what we are trying to say, is that stock market returns are broadly driven by earnings predictability and the current market regime; and larger stocks meet positive criteria for both these drivers.

There are currently multiple economic and sentiment indicators of a narrowing of the equity markets rally in India. We must pay heed to these currents.

The stock market rally that began in April 2020 lifted all boats but we are headed quickly for choppy seas. Deft seamanship will take you so far, and it is important to choose the boats with the strongest keels.