Pharma's Obesity Strategy: Catching the Next Big Wave.

From GLP-1 to New Horizons: Pharma's Obesity Revolution

Obesity is no longer a niche concern—it’s a global epidemic with staggering implications. According to the World Health Organization (WHO), in 2022, 2.5 billion adults were overweight worldwide, including 890 million classified as obese. In 2022, 42% of the adult population in the US was considered obese.

Between 1990 and 2021, the global prevalence of obesity increased significantly, Males: Increased by 155.1%, and Females: Increased by 104.9%. This global epidemic is driven by various factors such as unhealthy diets and sedentary lifestyles. The World Obesity Federation estimated that the economic costs of obesity could amount to EUR3.9 trillion or almost 3% of global GDP in 2035 if not prevented and treated. The emergence of GLP-1 drugs offers a promising avenue for treatment.

The GLP-1 Phenomenon: Current Duopoly

The emergence of glucagon-like peptide-1 (GLP-1) receptor agonists has started a (new) golden era for the pharmaceutical industry. These innovative medications, initially developed for type 2 diabetes, have demonstrated remarkable efficacy in promoting significant weight loss, capturing the attention of patients, physicians, and investors alike.

Novo Nordisk’s semaglutide (Ozempic and Wegovy) and Eli Lilly’s tirzepatide (Mounjaro and Zepbound) have become the poster children of this revolution, showcasing weight loss that was previously unattainable with pharmaceutical interventions alone. Semaglutide, a second-generation GLP-1 agonist, achieved around 14% total body weight loss in clinical trials, while tirzepatide, a dual GLP-1 and GIP (glucose-dependent insulinotropic polypeptide) receptor agonist, has demonstrated even more impressive results, with average weight loss reaching 22.5%.

The financial impact of these drugs has been nothing short of spectacular. Sales of GLP-1 blockbusters soared from a modest EUR4.5bn in 2021 to a substantial EUR21.2bn in 2023. This year’s sales are on a rapid boil at a year-on-year growth of +92%, with Ozempic expected to be the second best-selling drug globally in 2024, generating EUR17bn in revenue.

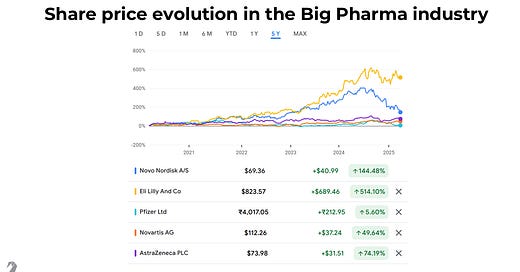

Novo Nordisk now reigns as the largest European company by market capitalisation, while Eli Lilly has positioned itself as a formidable rival in the US stock market. Investor appetites are whetted, with forecasts suggesting the GLP-1 market could balloon to EUR92bn by 2030.

Challenges in this Playbook:

Despite their success, GLP-1 agonists are not a panacea.

Cost: Monthly prices exceed $1,000 (e.g., Wegovy at $1,349, Saxenda at $1,300), often without insurance coverage for obesity, limiting access in low- and middle-income countries.

Side Effects: Gastrointestinal issues—nausea (44%), vomiting (24%), and diarrhea (30%)—are common, per STEP trial data, and can lead to discontinuation rates of 7–10%.

Muscle Loss: Rapid weight loss can reduce lean muscle mass by 25–40% of total weight lost, raising concerns about sarcopenic obesity, especially in older adults. A 2022 study in Obesity noted that GLP-1-induced weight loss mirrors caloric restriction in this regard.

Administration: Weekly injections deter some patients, reducing compliance compared to oral options.

While the GLP-1 current market leaders are experiencing a "gold rush", the increasing threat of competition from innovative new medicines, generics, and copycats, poses a significant risk to the high profitability currently enjoyed by market leaders.

Beyond GLP-1: The Other Innovations

While GLP-1 agonists have set a new benchmark, the quest for even more effective, tolerable, and accessible obesity treatments continues. The obesity drug pipeline is brimming with innovation, with 39 new GLP-1 drugs in development across 34 companies, alongside novel approaches targeting alternative pathways.

CALCR Agonists (Novo Nordisk): Cagrilintide, an amylin analogue targeting the calcitonin receptor (CALCR), enhances satiety. Combined with semaglutide (CagriSema), it achieved 15.6% weight loss in a phase 2 trial (2022) over 20 weeks, with phase 3 trials underway.

Triple Incretin Agonists: Drugs like Eli Lilly’s retatrutide, which act on GLP-1, GIP, and glucagon receptors, are showing immense promise, with early data suggesting even greater weight loss than tirzepatide.

GIP Antagonists/GLP-1 Agonists: Amgen’s MariTide combines GLP-1 agonism with GIP antagonism, a novel approach that has demonstrated remarkable early efficacy and the potential for muscle preservation.

Oral Incretins: The convenience of oral administration is a major draw, and several companies, including Lilly (orforglipron) and Structure Therapeutics (GSBR-1290), are developing oral small molecule GLP-1 receptor agonists that could offer a more accessible option.

Amylin Agonists: Targeting the amylin pathway, which plays a role in satiety and glucose regulation, is another promising strategy. Novo Nordisk’s amycretin (oral) and CagriSema (amylin/GLP-1 dual agonist), as well as Zealand Pharma’s petrelintide, are showing encouraging results and potential for combination therapies with GLP-1s.

Biased GLP-1 Agonists: Researchers are exploring GLP-1 agonists with biased signalling profiles that may offer improved efficacy and tolerability.

GPR75 Antagonists: Genetic studies have linked loss-of-function mutations in the GPR75 gene to lower body weight, making it an attractive target for drug development. Companies like Regeneron and Orion are pursuing this approach.

Muscle Preserving Agents: Preserving lean mass during weight loss is critical for long-term health, especially in aging populations. Addressing the issue of muscle loss associated with weight loss drugs is crucial for long-term health. Companies like Lilly (bimagrumab) and Regeneron (trevogrumab) are developing agents that target myostatin and activin pathways to preserve lean mass.

Mitochondrial Uncouplers: Increasing energy expenditure by targeting mitochondrial function is another area of research, with companies like Rivus Therapeutics (HU6) and OrsoBio (TLC-6740) exploring this mechanism.

NLRP3 Inhibitors: Targeting inflammation linked to obesity is a potential therapeutic strategy, with companies like Nodthera and Ventyx Biosciences developing brain-penetrant NLRP3 inhibitors.

Generics, and copycats

Generic alternatives may debut as patents expire, particularly for Semaglutide in China in 2026. The expiry dates for compound patents vary by country, with China being the first major market where Ozempic and Wegovy's patents will expire. Once generic versions are approved by local regulatory authorities, they can capture a substantial market share, estimated at 50% to 70% in the first year of commercialisation.

Copycat versions are particularly evident in the US, where compounding pharmacies are allowed to copy brand-name medicines that are in short supply. While these copycat versions may lack rigorous testing and safety assurances, consumers often prioritise quick and cheap methods, leading to high demand for these alternatives. This will forces Novo Nordisk and Eli Lilly to accelerate production to avoid further product shortages.

The Fight of Generics: Frugality vs Frugality

Both India and China possess well-established pharmaceutical industries known for their cost-effective manufacturing capabilities.

The cost of conducting R&D in India is substantially lower, about one-fifth compared to developed nations. This frugality extends to manufacturing generics as India has historically been a "generic powerhouse". Indian companies have strong reverse engineering skills and a low-cost manufacturing base.

At the same time, Chinese laboratories have the capacity to produce faster, on a larger scale, and at a lower cost, posing a significant threat to the pricing power of the original manufacturers. And, they have a head-start, as generic alternatives for Semaglutide are expected to debut in China in 2026 upon patent expiry. Companies like Hangzhou Jiuyuan and CSPC Pharma are already preparing to develop GLP-1 biosimilars, potentially slashing costs by 50%.

The competition between India and China, both striving for cost leadership in pharmaceuticals, could lead to a scenario of "fighting frugality with frugality", potentially driving down the prices of GLP-1 medications beyond what might occur with competition solely from Western manufacturers.

How Indian Pharma Companies are Navigating the Obesity Wave?

Indian pharmaceutical companies, known for their expertise in generics and contract manufacturing, are also strategically positioning themselves to tap into the growing obesity market. Apart from Generic Opportunities, which we have already covered, they are doing:

Biosimilar Development: Biosimilars of biologic obesity treatments represent another significant area of interest. Companies with established biosimilar development programs, such as Biocon, are likely to explore opportunities in this space.

New Chemical Entities (NCEs) and Novel Biologics: Several Indian companies are increasingly investing in innovative drug discovery, including NCEs and novel biologics that could potentially address obesity and related metabolic disorders.

Sun Pharmaceutical Industries: While primarily focused on specialty drugs, Sun Pharma has a research and development pipeline that includes potential treatments for metabolic diseases. Their acquisition of Deuruxolitinib indicates a focus on related therapeutic areas. They are also developing GL0034 (Utreglutide), a GLP-1 receptor agonist, which has shown clinically meaningful weight loss in early-stage studies.

Zydus Lifesciences: has a novel pipeline that includes Saroglitazar, which is in Phase II/b trials in the US for NASH (non-alcoholic steatohepatitis), a condition often associated with obesity and metabolic dysfunction. They are also developing other novel molecules targeting metabolic diseases.

Dr. Reddy’s Laboratories: has a subsidiary, Aurigene, which focuses on the discovery and early clinical development of novel therapies, including in oncology and immune-inflammatory diseases, areas that can be linked to obesity.

Wockhardt: has a focus on diabetes and biologicals, including GLP-1 agonists in their development pipeline.

Suven Life Sciences: While primarily focused on CNS disorders, Suven has a pipeline of discovery molecules, and metabolic diseases could be a future area of exploration.

Shilpa Medicare: through its subsidiary Shilpa Biologicals, has biosimilar development programs that could potentially extend to treatments relevant to obesity and metabolic health.

Contract Development and Manufacturing (CDMO): Indian CDMOs can play a crucial role in manufacturing GLP-1 drugs and other obesity treatments for global pharmaceutical companies, leveraging their cost-effectiveness and manufacturing capabilities.

The GreySwan Insights: Second Order effect?

For Food Industry

With nearly 15 million expected users in the US by 2030, these individuals are likely to suppress cravings for high-calorie and processed foods. Clinical studies show that patients on GLP-1 medications experience an average reduction of 20-30% in overall calorie intake. This effect is particularly strong for calorie-dense foods, with users reporting a substantial drop in consumption of sweets, snacks, and beverages with high sugar and fat content.

To stay competitive, the food manufacturers will need to adapt by:

Whipping up smaller portions.

Creating healthier recipes.

Even exploring “natural GLP-1 boosters“ for those unable or unwilling to take the pharmaceutical route.

Innovating with protein-rich snacks and functional foods enriched with fibre and essential nutrients.

Developing nutraceutical products that counter the side effects of GLP-1 drugs.

Providing alternatives after users quit GLP-1 medications to sustain some of their effects on weight management and glucose control.

Leveraging the client base of individuals unable to take GLP-1 medications by presenting them with alternatives.

Natural GLP-1 stimulators

The rise in GLP-1 use also presents considerable growth opportunities for producers of ingredients and nutraceuticals, especially those producing natural GLP-1 stimulators such as prebiotic fibres, berberine, resveratrol, curcumin, and ginseng.

Companies behave more like living organisms than predictable machines. They’re shaped by human decisions, market ecosystems, and external pressures, all of which introduce a level of chaos that defies simple linear models. Be ready for some new winner from this playbook.