Quick Commerce and the Demand for Instant Gratification

From Clicks to Minutes: The Transformation of Shopping

“The Four Questions?” “As put forth by Mettleheim: How did this happen? How could this happen? Is it exceptional? How will it be avoided in the future?”

― Colson Whitehead, The Intuitionist

Traditional Retail to E-com, and the Rise of Q-Com

Traditional retail formats, like kirana stores and modern trade (MT), have long dominated the Indian market. Kirana stores offered convenience but often with limited assortment and higher prices, while MT provided a wider selection but were not always accessible or conveniently located.

The emergence of e-commerce introduced online shopping, offering a broader range of products but with delivery timelines that often spanned days.

Entered the slotted e-commerce players like BigBasket and JioMart (D-Mart ready), they provided scheduled deliveries and wider assortments but lacked the immediacy that QC offers. Here is an extract from the book - Saying No to Jugaad: The Making of Bigbasket (by T.N. Hari), that explain the reason behind slotting.

Bigbasket had realised quite early that in India 70–75 per cent of grocery purchase was planned at the beginning of the month. Around 20 per cent was top-up purchases mid-month or mid-week. And 5 per cent of the purchases were from local specialty stores. Bigbasket had been servicing the planned monthly purchase and had been contemplating catering to the top-up requirements through an express service. And that is how Bigbasket ended up acquiring Delyver.

Q-Com's growth was initially spurred by the COVID-19 pandemic in 2020, as consumers sought convenient ways to access groceries and essential items.

Is Quick Commerce (QC) Just a Fad?

I thought so, few years back. And, I was horribly wrong, given my frequency of using the both the apps - Blinkit and Instamart. Fun part, I haven’t used Zomato or Swiggy in the same time period. OK. Let’s talk about the big picture rather my-alone-views.

The QC market is experiencing massive user traction, with a Gross Order Value (GOV) of USD 3.7 billion in FY24, and is expected to grow to around USD 32 billion by FY30. Some sources project even higher figures, with the market potentially reaching USD 42 billion to 55 billion by 2030. This indicates a substantial long-term growth trajectory. The total addressable market (TAM) is estimated to be USD 211 billion by FY30, with a CAGR of 22% from FY24 to FY30. This is far from a short-term trend.

The current penetration of q-com is still low, with only 6% of the estimated TAM captured as of FY24. This suggests a significant runway for growth and indicates it is not a saturated market.

India is a largely a consumption-driven economy, and our burgeoning middle-income segment will be at the vanguard of this growth.

Quick Commerce : Beyond Groceries and Essentials

The quick delivery proposition of q-com is not just about top-up purchases; it is increasingly influencing regular household shopping, expanding into diverse categories and blurring the lines with horizontal e-commerce. This expansion is driven by consumer demand for convenience and speed across a wider range of products, and the strategic aims of QC platforms to increase average order value (AOV) and market share.

Players are expanding into high-growth categories like beauty and personal care (BPC), pharmaceuticals, electronics, kitchenware, home and household appliances, fashion and accessories, toys, stationery, and even small-ticket discretionary purchases. Here is a snapshot from India’s biggest FMCG player about the margins across segments (why Beauty is important)

They seek to capture a larger share of consumer spending and transform from an "impulse purchase/top-up platform" into a platform for regular stock-up demand.

The Economics of Instant Commerce

Market Size: CLSA in their Swiggy IC (10 December 2024) estimated US$27bn TAM for quick commerce by FY27CL.

We believe this overall TAM growth will be driven by 2 factors: (1) expanding assortment leading to wider target market as categories such as Alcoholic beverages get added and (2) rapid geographical expansion driven by penetration into new cities as well as further expansion and addition of larger dark store networks in some of the existing cities.

-CLSA’s Note

Path to Profitability

Unit Economics

Key Components: Unit economics in q-com typically involve the following:

Average Order Value (AOV): in Q2FY25, Blinkit's AOV was Rs 660 while Instamart's was Rs 499.

Revenue per Order: This is influenced by commissions, ad revenue, platform fees and delivery charges.

Commissions: Commissions from suppliers/brands are a key source of revenue.

Advertising Income: Income earned from brands for advertising on the platform.

Delivery Fees: Charges collected from consumers for delivery.

Platform Fees: Fees charged to users for using the platform.

Cost of Delivery: This includes last-mile delivery costs.

Dark store costs: Expenses associated with running dark stores, including rent, inventory management, and staffing.

Customer Inducement, Tech, Other Costs: These are platform funded discounts, customer acquisition costs, technology related costs, and other variable costs.

Contribution Margin: This is calculated by deducting the variable costs from revenue.

Adjusted EBITDA is a measure of profitability that takes into account earnings before interest, taxes, depreciation, and amortisation.

Comparative Analysis:

Blinkit vs Instamart: Blinkit has generally better unit economics than Instamart. For example, as of FY24, Blinkit had a positive contribution margin, while Instamart's contribution margin was negative. In Q2FY25, Blinkit's contribution per order was Rs 25, whereas Instamart's was -4 Rs.

Blinkit has a higher AOV than Instamart which has a positive impact on its unit economics.

Blinkit's revenue per order is also higher than Instamart's.

Delivery Costs:

Last mile delivery costs are a significant part of q-com operations.

Q-com deliveries tend to be shorter in distance than food deliveries.

Delivery costs in q-com are as low as 7-9% of AOV.

The last-mile delivery costs in q-com can be optimized through higher density and increased AOVs.

Impact of Scale:

As q-com operations scale, the costs tend to decrease, improving the unit economics.

Higher throughput per dark store improves profitability as stores mature.

Profitability

Many q-com businesses are currently focused on growth and are not yet profitable, with some incurring losses even at the contribution margin level. The timeline for achieving profitability is influenced by the pace of expansion and competitive intensity. The q-com market is expected to move towards sustainable profitability, with projections of 4-5% of Gross Order Value (GOV) for major players.

Contribution Margins: Steady state contribution margins in the quick commerce business are expected to be around 7-8%.

Adjusted EBITDA Margins: The adjusted EBITDA margins are expected to reach 5% or more by 2030 for market leaders. Some estimates suggest that q-com margins could eventually be as strong as, or even stronger than, those in food delivery.

Factors Affecting Profitability:

Scale: Achieving a large scale is important for profitability, with market leaders expected to capture a disproportionate share of the industry's profit pool.

Take Rate: This includes commissions, ad revenue, platform fees and customer delivery charges. The take rate for q-com is expected to reach 20%, while food delivery's take rate is around 25%.

Advertising Revenue: QC platforms have the potential to earn significant advertising revenue.

Convenience Fees: Charging convenience fees to customers is another way.

Cost Optimisation: Improving supply chain efficiency, reducing wastage, and leveraging topical trends for increasing AOV.

Dark Store Economics: Optimizing the economics of dark stores is crucial for profitability.

Average Order Value (AOV): Higher AOVs can help drive profitability for platforms.

Operational Efficiency: Optimizing operations, reducing costs, and increasing efficiency, including using gig delivery executives, are also essential for improving profit margins.

The Logistics Behind Instant Delivery

The ability to provide near-instant delivery, typically within 10-30 minutes, requires a complex and efficient logistical framework that differs significantly from traditional retail and even standard e-commerce models.

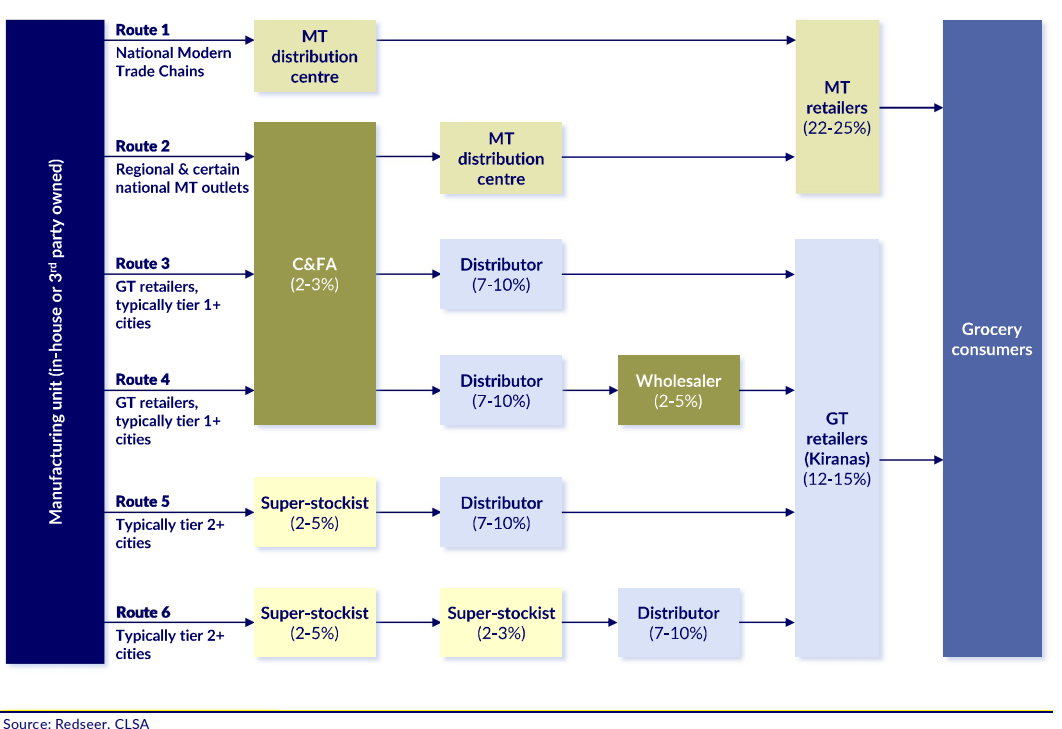

Take a look at this interesting graphics from CLSA’s note on ‘Grocery and consumer staples - supply chain’

Now, here's a breakdown of the key aspects of the logistics behind quick commerce:

1. The Dark Store Model:

The foundation of QC logistics is the dark store. Unlike traditional retail outlets, dark stores are not open to the public; instead, they function as mini-warehouses strategically located in close proximity to consumers.

They allow for higher sales density, as they are optimised for picking and packing rather than browsing and shopping.

Swiggy innovated by implementing dark stores near consumers, overcoming the drawbacks of earlier models that involved picking up from existing local stores.

Blinkit also uses the dark store model and has a higher throughput per store compared to Instamart, owing to efficient operations and a wider assortment.

2. Hyperlocal Operations:

QC focuses on hyperlocal delivery, with delivery distances typically ranging from 2-3 km. This short distance is crucial for achieving the fast delivery times promised by QC platforms.

Delivery partners need to be familiar with the local routes and entry points of residential complexes to ensure prompt deliveries.

The average delivery time for QC is 10-15 minutes, compared to 30-40 minutes for food delivery.

3. Inventory Management:

Efficient inventory management is critical for QC. This involves forecasting demand, ensuring high inventory turnover, and minimising pilferage.

QC platforms aim to achieve a faster replenishment cycle and lower working capital cycle by having lower inventory days.

Companies are using technology to automate operating procedures and optimise space utilisation within the dark stores.

4. Delivery Fleet Management:

Unlike food delivery, QC's last-mile delivery architecture is simpler, allowing for a higher number of deliveries per hour. This is because it is a 'one to many' model where the delivery partner is taking multiple orders from the dark store to different customers. In contrast, food delivery is a 'many to many' model, with different restaurants having multiple orders to different customers.

The faster delivery timelines allow for a greater number of deliveries per delivery rider in QC compared to food delivery.

Some platforms are experimenting with multi-drop or batched deliveries, further optimising delivery efficiency. Delivery partners may be cross-trained to perform multiple functions such as food delivery and medicine delivery.

Investing in Instant: The Future of Quick Commerce

“Like people say—if you want to make God laugh, tell him you’ve got plans.” -"Man plans, God laughs."

― Terry Hayes, I Am Pilgrim

To be or not to be. Will you invest in the stocks of Zomato, Swiggy, or in the near future the IPO of Zepto?

Most of the investment reports on this sector can be summarised as

Investing in either Swiggy or Zomato presents a compelling opportunity to gain exposure to the rapidly growing quick commerce (q-com) and food delivery markets in India. The q-com market is predicted to grow at a CAGR of over 50% between FY24 and FY29. Swiggy's Instamart and Zomato's Blinkit are key players in this space, with Blinkit currently holding a larger market share of 47%, compared to Instamart's 27%

Now, if you ask machine, aka AI. It might give their recommendation as:

Zomato as a Primary Pick: Zomato has overtaken Swiggy in both food delivery and q-com in terms of gross order value (GOV) and transacting customers. Zomato has demonstrated better execution, cost control and profitability than Swiggy.

Swiggy as a Secondary Play: Swiggy's valuation is at a discount to Zomato's due to its smaller scale and delayed profitability. This may present an opportunity, as the gap between the two companies narrows. Swiggy has shown improvement in its fixed and variable costs, which should sustain

Diversified Portfolio: Both the food delivery and q-com markets in India are underpenetrated, indicating a long growth runway for both companies. Given that both companies are likely to be among the fastest-growing consumption names in India, it may be beneficial to include both in a portfolio.

Long Term View: Both companies have the potential to deliver significant returns over the long term, given the low penetration of food delivery and quick commerce in India.

But, if you ask me, about my personal recommendation. I, being a conservative investor will say, AVOID. Since all the good things are priced and any mis-step will lead to the downfall.

Risks and Challenges

The sector, while offering substantial growth potential, faces numerous risks and challenges that could impact its profitability and sustainability.

Intense Competition: The q-com landscape is highly competitive, with established players like Blinkit, Swiggy Instamart, and Zepto vying for market share, alongside new entrants such as Flipkart and Amazon. This intense competition could force companies to lower service charges (business hardly has any customer loyalty), thus reducing profit margins. There is a risk that the high valuations currently ascribed to the q-com segment may be at risk if the competition becomes too disruptive. Maintaining unit economics in the face of competitive pricing and operational costs will be a challenge.

Profitability Concerns: The path to profitability can be complex, with the need to balance growth with cost-effectiveness. The need for promotional spending to acquire and retain new users can lead to cash burn. Cash Flow Issues: The longer working capital cycle for logistics services can lead to cash flow problems.

Supply Chain Complexity: Q-com has a more complex supply chain than food delivery, involving warehousing and merchandising operations. It requires managing sourcing, distribution, and inventory. Setting up and managing a dark store network is complex. The quick commerce model depends on efficient dark store operations, including inventory management, demand forecasting, and logistics. The limitations in terms of the number of SKUs and the size/weight of parcels it can handle.

Regulatory Scrutiny: There is increased scrutiny on the sector by regulators, with the potential for interventions in the form of labour laws, take rates, and delivery charges. The current e-commerce policy does not specifically address the q-com business model, creating the potential for regulatory changes. Potential changes in labour laws for gig workers could impact operating costs and add complexity to the operating environment.

But, then I was wrong 2 years back, and can be wrong again!

“I have learned all kinds of things from my many mistakes. The one thing I never learn is to stop making them.”

― Joe Abercrombie, Last Argument of Kings