Steel Rally : Sleep with one eye open

Metals are internationally priced commodities and India is a price-taker

There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it's the end of a bull market or the end of a bear market. - Paul Tudor Jones

Dear Readers, as we approach 2022, steel sector stocks are prominent in many of our portfolios. A question on the minds of many of us will be - where are we with regards to the Steel cycle?

The Grey Metal

The Industrial Revolution changed the world. Mankind broke free of its bonds to the soil, and began building giant structures like skyscrapers and bridges. The huge growth in population that followed also drove much growth in demand for steel. Steel is the grey metal that supports concrete, which is the foundation of our civilization. The services built on concrete are what we often call ‘growth in the economy’. Steel can be described in general terms as iron with most of the carbon removed, to make it tougher and more ductile.

The steel sector is very cyclical.

Steel demand follows industrial production and industrial production follows economic activity, as such, it is no surprise that many steel companies do well during economic expansions and real estate booms. The cycle of course is also dependent on seasonal changes as well as commodity movements.

FY 2021, A Golden Year for Steel Companies

2021 was a breakout year for the steel sector. Demand for commodities heated up as China controlled the virus and saw an expansion in industrial activity. Existing capacities of both steel and iron ore manufacturers struggled to keep up with the demand, a mismatch exacerbated by supply chain issues and increasing raw material costs.

The price of steel and iron ore skyrocketed, leading to supernormal realizations for steel and mineral companies that had benefited from the consolidation in the industry during the past few years. Naturally, the NIFTY METAL Index, half of whose constituents are Iron & Steel manufacturers, has massively outperformed the index.

Source: TradingView

Raw Materials for Steel Production: Is the ground shifting?

Steelmaking is the process of applying heat and a reducing agent to iron ore, in order to produce the metal, usually in bar or slab form. Steel can be produced either through an Electric arc furnace or through "basic oxygen" processes. These processes produce steel suitable for a range of purposes.

November saw a massive short buildup in steel stocks in spite of a spectacular set of results.

Indian steel demand had stopped accelerating in H2'21 when compared with April 21. Was this a case of selling the news?

Let's examine what changed recently :

Iron ore requirement, which accounts for 15-20% of the cost of production of steel, is entirely met from domestic sources. Iron ore prices have halved in the last six months, owing partly to large scale production facilities coming online (Arcellor Mittal-Nippon Steel JV 20MT pellet plant is online, Tata Steel's projected expansion of 6MT plant), due to the Chinese 'embargo' on Australian iron ore.

Prices of Coking Coal, the other key input, continue to remain elevated, trading at $400USD/tonne (FOB), up about 4x from the FY20 lows of $100USD/tonne. Unlike Iron Ore, Coking coal is mostly imported by domestic steel players and prices have stayed firm globally.

Other inputs like Nickel, Molybdenum and Zinc has mimicked the rise in steel demand and are trading anywhere between 2x-4x since last year April.

The key question then is whether consumers of steel will be willing to continue buying at high prices when raw material prices fall, or will there be pressure on steel manufacturers to reduce prices.

Another ponderable is that given heavy consolidation in the steel industry through 2015-2020, a cartelized co-opetition dynamic may emerge - wherein the prominent players decide to sustain prices in rational competition. This dynamic further depends on the future policy of the Indian government on export caps and duties.

Changing nature of competition and demand...

Apart from raw materials, the demand dynamics of the industry seems to be altering:

Chinese demand is crashing and set to crash further as CY21 continues to unwind. More than being a key market for Indian Iron Ore exports, China is an international price setter for steel.

Indian demand has softened on the back of the monsoon season, and weak auto sales.

The only geographic spot where HRC steel prices have not softened is in the USMCA region, where HRC (hot-rolled coil) continues to trade at an eye-popping price of 2000USD/mt. In contrast, the ASEAN region trades at a benign 800-900USD/mt.

On the other hand, the steel bulls and OG steel industry captains believe that this cycle is different from those before (ergo, this time its different!) as demand is driven by a global shift to clean power and the associated demand for steel in clean power structures, instrumentation and tooling.

The competition is also shaping up in new ways:

Nippon Steel has restarted all the blast furnaces that were under banking last year

Arcelor Mittal and its Nippon Steel joint venture has been expanding their production in Western Hemisphere (Calvert is fully operational)

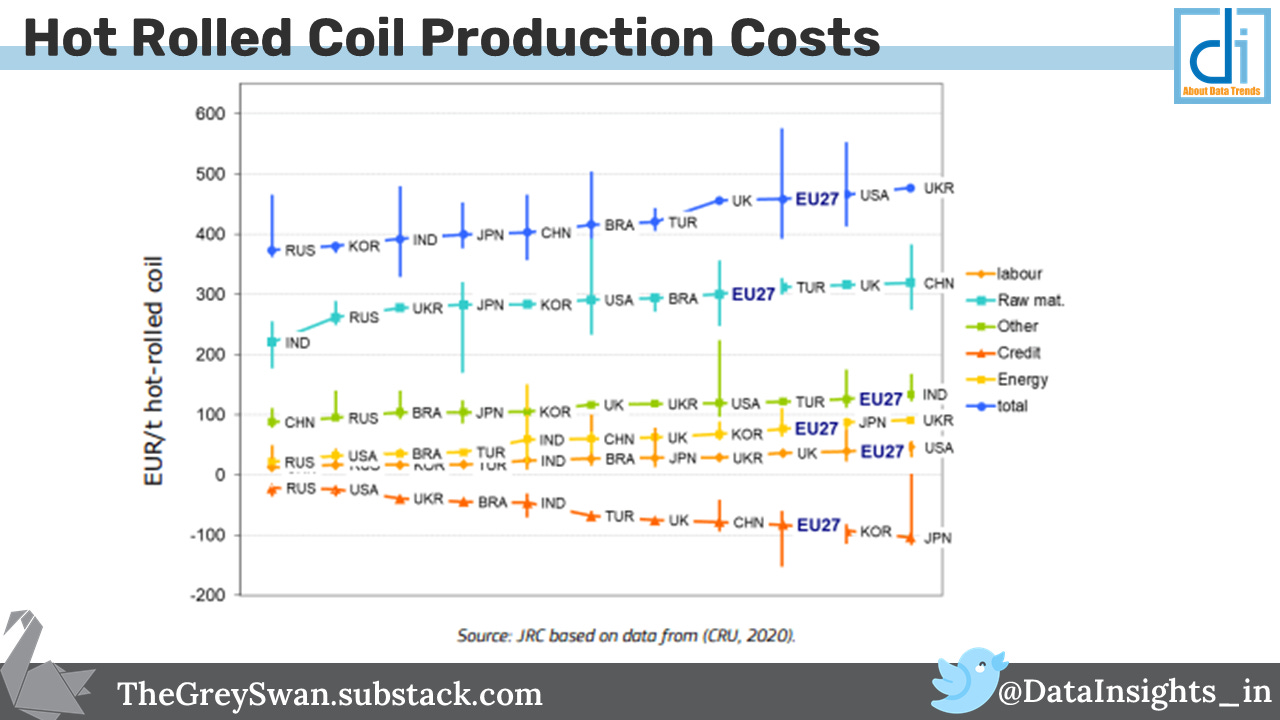

POSCO is profitably expanding on the back of competitive cost structure, undercutting Indian supply in South East Asian markets (Read, the blue line: Notice how the lone Korean player and the average Russian player has lower total cost than the average Indian player)

What does it mean for Indian players?

The Auto industry, one of the largest consumers of flat steel products - had its worst festive season in a decade as growth remains sluggish (~9% QoQ) and the post-covid recovery lagged expectations. Additionally, higher port inventory numbers and newer downstream facilities point to slowing revenues.

The dip in domestic steel production in China was earlier a piece of good news as it provided a ready market for Indian exporters to benefit from; but now with Chinese demand is also dipping, a major market is now turning unremunerative.

Exports have been slowing down this year. As per Joint Plant Committee Report, in the month of October 21, finished steel exports were down by 22% on a month over month basis.

On the plus side commentary from JSW, Tata Steel has been positive about maintaining EBIDTA going forward but as it goes with such things, take it with a pinch of salt.

It is important to consider the direction of future government policy. CREDAI, a confederation of real estate developers in India has raised alarm on rising steel prices and sought government intervention. Real Estate and Auto are key downstream industries and make a significant contribution to employment and GDP in India. Sustained high steel prices are not in their interest. Protecting their interests will weigh on future Government decisions.

Actionable Insights

What is the likely direction of the steel rally? Are we early in a super-cycle? What must an investor in the grey metal do, as she is faced with conflicting evidence?

Luckily for steel, we have historical precedents in past boom-bust cycles. In 97–'98, the Asian financial crisis reduced global demand for steel products. Metal and mineral exporters such as Russia and Brazil turned to the US where industrial and construction activity was still thriving to dump their extra capacity.

Even though US demand of basic materials was strong, metal prices dropped 25% from this new flood of foreign supply, sending metal & mining stocks down by over 20%.

It is likely a similar scenario may play out with new POSCO and other large player capacities coming online and a change in the stance of Chinese policy, if it involves dumping of excess output into geographies like India.

Share prices move on the expectation of change in underlying fundamentals - positive or negative. If an investor in the steel sector has to profit going forward, an improvement in any or all of these three should be present: Revenue growth, Margin expansion or Sentiment improvement.

Revenue growth may not be a source of supply anymore. South-East Asian region has gone on a wait-and-watch mode, as China realigns its growth bearings. Indian steelmakers are undercut by other steelmakers as prices tumble. For instance, hot-rolled coil export offers to Vietnam (by Indian steelmakers) were undercut by Russian steel mills by about $50-55/tonne on a CFR (cost and freight) basis.

While domestic consumption revved up last year on the back of government-led CAPEX, the market doesn't anticipate an acceleration in it.

Auto Industry, which is the main consumer of flat steel products, and was expected to show up earlier this year, is still posting sluggish growth.

As global supply chain issues get resolved and new global capacities come online, a cooling down of the exports market also implies little to no margin expansion till H2'FY23.

That leaves behind sentiments, as the sole driver of prices. Put in other words, any buyer here is expecting the momentum to continue. Evidence abounds that points to momentum investors steadily exiting the steel sectors.

So dear reader, do form your own inferences. While you do so, we leave you finally with the below summary of drivers.