Technology Platforms, Indian Banks and Fintechs: What Fintechs are up against.

Private Indian Banks are spending a truckload of their operating expenses on building new financial platforms. Close gardened, for now, one thing is certain - it's bad news for Fintechs.

“Don’t do that!”

This is what Andrew Ng says. When people ask Ng (pronounced nee-yuh), how can one build an “AI-first” business, he replies “Don’t do that. Forget about building an AI-first business. Be customer-led or mission-led.”For those who are unfamiliar with him, he is the teacher emeritus of modern AI, having trained more than 2.5mm students. His answer is surprising for an AI advocate and a technology optimist.

Assessed at its core, this advice is valid not only for AI/ML type of technology but also for any other form of “back-end” technology. That includes automation, data analytics or even migrating existing workflows from on-prem to cloud.

What doesn’t gain customers has no business value. This is a lesson ignored and forgotten by Indian Fintechs.

Customer Acquisition Engines, 3% of Revenue and stealing Fintech’s cheese

Slice it or dice it in any way, traditional private banks like HDFC Bank, ICICI Bank, and IndusInd Bank are far more powerful customer acquisition engines than the best of Fintechs can aspire to be.

This strength arises from their 2 fold advantage, none of which is surprising - being a universal bank, and aggressive spending on marketing.

Take ICICI Bank for example. It has spent ~49bn INR in FY 21 solely on marketing-related activities. That is close to $670mn in a year alone. Secondly, the entire buffet of financial products that is available to the customer turns these banks into a “financial supermarkets”.

But what’s striking is, that the banks are not only settling for these advantages. They have also turned ‘hungry’.

They are heavily deploying their operational budget into building platforms that will act as “pain-killers” for their customers.

Take IndusInd Bank(IIB) for instance. IIB has deployed IndusEasyCredit technology stack with the goal of making credit disbursement happen through a one-stop digital shop. The upshot? The cost of application processing has come down by 80% for IndusInd bank. The icing on the cake? It is fast gaining traction with the platform having generating 300k inquiries per month.

Or take IIB’s, recent push into digital solutions for small merchants, vehicle ownership journey, etc. The theme is clear - “go digital to go big”. And its not only IIB who is doing this. ICICI BANK (ICICI) is spending about 3% of its revenue on building technology platforms. Let that sink in. In FY’22, it raked about 1200bn INR in total revenue.

Apps for small businesses, supply chains, merchant ecosystems, bulk payment or even business banking - ICICI is transforming itself very quickly into a fintech itself. A $70bn fintech!

Seasoned VCs know, there is a huge chasm between having an app, acquiring clients and making money. These apps are not empty promises in the wind. They are generating viable businesses. The monthly spend via “ICICI Stack” - the digital solution for merchant ecosystems has jumped 2.3x in a single year. Merchant OD limits have zoomed 3.7x on a year-on-year basis. The average annual balance has grown by 2.1x.

These solutions are scaling up and gaining traction. Fast. Which only means one thing. The space for fintechs to grow and thrive is also shrinking. Alarmingly fast.

Technology Investments: Banks vs Fintechs

Circle back to Andrew Ng’s advice and revisit the idea behind it. In a business, the business comes first, technology later.

The private banks are investing all their incremental dollar in customer-facing technologies. (cue IndusInd Bank and ICICI Bank). Fintechs, unfortunately, are spending all their capital on building the back-end of their processes.

Customers vs Processes. UX vs Automation. The comparison is clear.

Indian lending fintechs are trying to take the same leaf out of their friend’s playbooks. Burn money, buy scale, figure out shit in the meanwhile. But without an appropriate business framework, fintechs run a serious risk of being a “flash in the pan”.

The reason?

Traditional startups are in services business; sell services get cash flow. Fintechs are in the risk business. Buy risk, get cash flow. The buying comes first, cash flow comes distributed over a longer period. Between the purchase and the eventual payoff, there is a huge gap.

A time gap.

Done badly, this time gap can turn into a bomb.

A ticking bomb.

On the flip side, one can’t blame fintechs for prioritising technology over a viable business. Fintechs, after all are trying to learn multiple skills all at once.

Be it underwriting. Collections. Automation. Culture. Risk Management. Contrast this with the operations of a prominent bank - their core operations are alive and kicking - they have already mastered 4 out of 5. The part that they have not yet is Technology/Automation. Their business is hale and hearty. They are gaining customers, and most importantly keeping them. And, they are investing in technology platforms to stay abreast with the new challengers.

If the raison d’etre of fintechs was that incumbents would prove to be too complacent to innovate, they are getting beaten at the pace of modernisation that banks are doing today.

One might argue that comparing fintechs with universal banks like ICICI BANK, INDUSIND BANK is not a fair comparison.

Agreed. Let us compare Fintechs with 5-year-old - AU Small Finance Bank.

AU Small Finance Bank is garnering a better valuation than most Indian Fintechs, because they have got their operations right first. Of note, AU SFB didn’t even have a credit card product as last as 2019. Yet, they are investing about 16% of their workforce on their digital bank agenda i.e. revamping technology, digital marketing, product analytics, digital sales, and backend ops automation. Most Fintechs do not even have 200 employees building customer-facing digital solutions.

Oh-Ken, The Skill of Underwriting, Fintechs, and NBFCs

In spite of the grim tone that this article adopts, optimists would like to see a more positive landscape than we have painted. They cite OCEN, Account Aggregation and everything in between to support their hypothesis. Let us tell you why the optimism is misplaced:

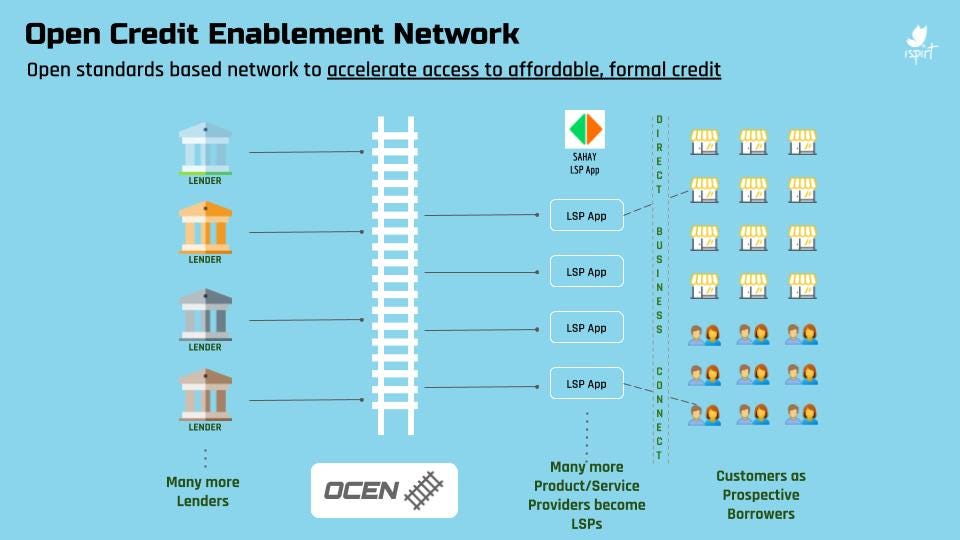

OCEN (pronounced Oh-Ken), stands for Open Credit Enablement Network. As the name suggests it aims to ‘enable’ credit, or as we at Grey Swan like to say fix the plumbing through which credit flows in India. An easy way to think about it is - “it intends to do the same to credit, that UPI did to ‘debit’ (payments).”

The OCEN architecture relies significantly on Account Aggregation to access the financial information of a particular user. Optimists considered that OCEN/AA combination can be a shot in the arm in preventing credit frauds and increasing the reach of a particular fintech.

We are skeptical. We believe that OCEN takes care of the plumbing, and not the art and skill of underwriting. Something that Fintechs lack sorely in. Secondly, frauds will still seep in through AA setup, only it will not be small ticket item frauds, but sophisticated digital equivalent of ‘long-cons’.

Fintechs will find themselves desperately ill-equipped pretty soon. Stories are seeping through our network where we are hearing instances of procedural lapses (flagged accounts still granted lines of credit, duplicate KYCs not getting detected at the login stage, etc. ).

The skill of underwriting is an extremely complex problem. But fintechs have a much deeper problem on their hands - that of collection. Which brings us to the case of NBFCs.

If one peels away the marketing/technology layer away from fintechs, they are inferior cousins of NBFCs. Sorry guys, you just are. Yet analysing the growth pattern of NBFCs reflect something very interesting.

All NBFCs started from a particular geographic pocket (Bandhan from East India, Gruh Finance from West India, Can Fin Homes from South India, IndiaBulls from North India, Aavas Financiers from West India etc.)

All NBFCs learn about underwriting by building tons of human experience first; amplify it with top notch collections and create a feedback loop between collections team and underwriting team.

Fintechs have upended both the tenets, not by performing them better, but by refusing to acknowledge it. By refusing to acknowledge the role of collections, fintechs considered going national is a no-brainer. By refusing to acknowledge the importance of underwriting, fintechs attacked credit from a ‘technology angle’.

It is not that surprising that fintechs are stuffed with young technologists rather than old bankers. We consider it to be part of their DNA, or their ethos - “move fast and break things”. We at GreySwan, suspect this doesn’t help in credit lending.

What Next?

We believe, fintechs should get a viable business going first. This implies starting from a single district first if need be, collecting data at every point of the interaction if one can, building multiple diverse credit scoring models if it comes to that - but most importantly build a collections team, dammit! Unsecured lending of the nature fintechs are doing are tough businesses, as they are discovering. Master secured lending first.

Today “Third Payment Defaults” (TPD) hover at 5% for the industry - and this is not coming under control anytime soon. Unless one starts putting boots on the ground and building a state-of-the-art collections team OR robust Fraud-preventions - there is no light at the end of this tunnel.

Denial is not a strategy. Innovation is. Accepting the cold inconvenient truths make poor fundraising decks. But building a billion dollar revenue fintech is once in a lifetime opportunity.