The Game of 5 Banks

A cross-sectional analysis of 5 Indian banks told in a "Game of Thrones" style

The first and most important rule of gun-running is: Never get shot with your own merchandise.” - Yuri Orlov, “Lord of War”

Mohnish Pabrai was a technologist before he turned to investing the proceeds from the exit of his tech-startup . But once he turned to investing, he pledged he will never invest in technology.

Guess, that’s the curse of knowledge. Or perhaps familiarity. Since “familiarity breeds contempt”. It is those who are the most familiar with a sector, its them who hold the most revulsion for it.

Over the course of the next 5-7 “scrolls” (the new unit of mobile reading), we will take you through a whirlwind tour of the underwriting practices, liability management, and the business model of each of the following banks:

ICICI Bank

INDUSIND Bank

EQUITAS SFB

AU SFB

BANDHAN Bank

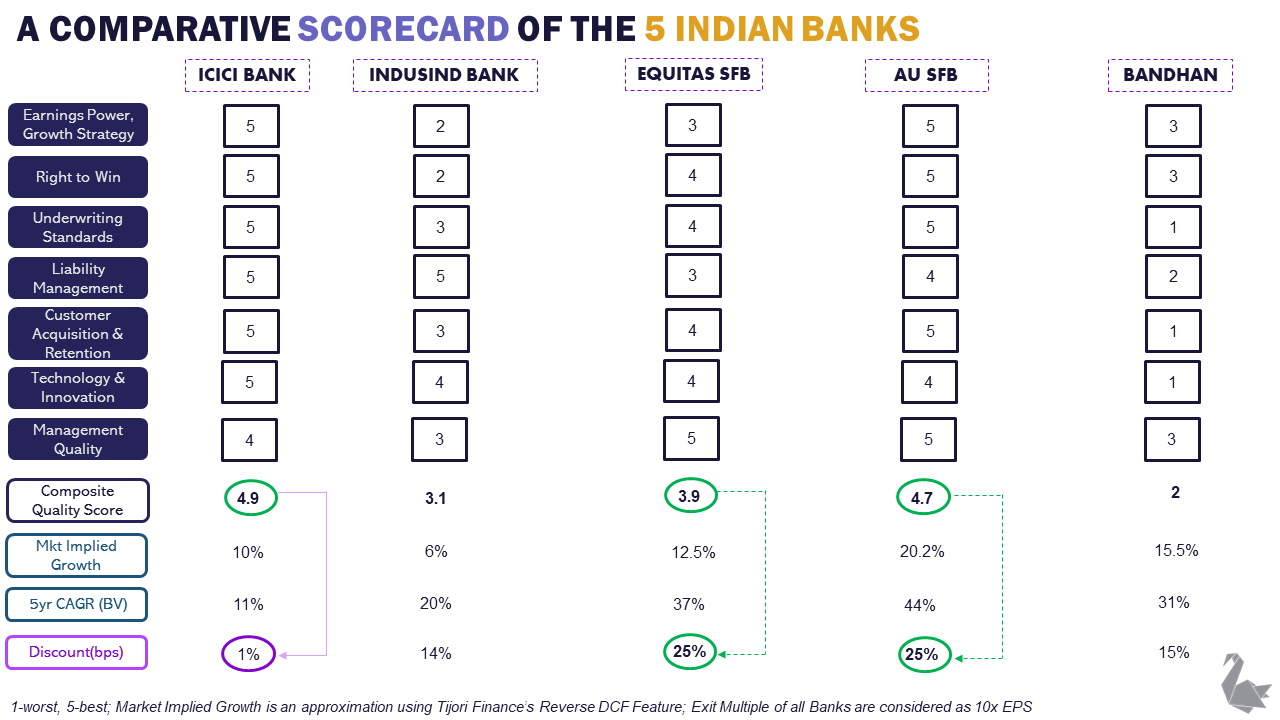

The summary goes like this on a scale of 1-5, each of the banks. ICICI Bank and AU Small Finance Bank stand heads and shoulders compared to the rest. Bandhan Bank and IndusInd Bank are the runt of the litter. Equitas is the underdog.

Blending their curent valuation and the market-implied expectations, Equitas SFB and AU SFB appear undervalued. ICICI Bank appear fairly valued.

Wait, wait, we know what you are thinking. Banking, pfft…boring! Its for losers and grampas who love peering in numbers. Duh!

Yes, yes… But let me try to do something different and interesting. Let’s gamify it, shall we? Let’s weave a story around it. A story reminiscent of “Game of Thrones”. A fight to the death filled with intrigue, drama, and conflict.

This is the “Game of Banking”.

ICICI Bank a.k.a. the Giant

INDUSIND Bank a.k.a the Outcast

EQUITAS SFB a.k.a the Silent

AU SFB a.k.a the Young

BANDHAN Bank a.k.a the Brawler

ICICI BANK - “The Giant”

The Credit Underwriting of ICICI Bank:

The Giant walks the Middle Earth like he owns it.Undefeated, unchallenged. During the Great Winter, he was led down a self-destructive path, by advisors who ought to have known better…

ICICI Bank has been on a spree to de-risk its loan book over the last few years. The banking behemoth had erratic growth in the past decade,beset by less than savory leadership . At this time, its fellow competitor - HDFC Bank left it in the dust, both in terms of valuation and loan quality.

The Giant today is aggressively moving its non-retail loan book up the rating ladder (71% is A-, compared to 46.3%, 5 years back: rating agencies have also got tighter in the interim, post ILFS-CARE fiasco). Retail loan on the back of increasing granularity, has given a fresh fillip of growth to Personal Loan and Credit Card book.

Liability Management

He was battle-hardy. He had prudence that came from surviving a hundred battles, with the aggression of having won all of them.

ICICI Bank has the lowest cost of deposits in the entire ecosystem at 3.47% - spread across foreign currencies, low cost infrastructure bonds, demand deposits and long term debt. At an LCRof 130%, its balance sheet looks unassailable.

The rising interest rate regime poises interesting opportunities for ICICI Bank. On one hand customers who migrated away during the interest rate down cycle, will scramble to refinance their debt, preferably by someone cheaper (read: ICICI). On the other hand, rising interest rates often improve the asset-liability management, as higher IR reduce duration of the loans. So it’s great for banks with great franchises.

However, in the last quarter, its credit to deposit ratio dropped to 77%, something that is obviously a worrying sign.

Strategy & Growth

A terrific cross-selling engine, it prides itself that 75% of its mortgage borrowers have deposits with it. It currently aims to “mine the client wallet” deeper, with a focus on end-to-end coverage of a client’s financial needs for every life stage.

Currently it is spending a whopping 3% of its annual revenue on building technology platforms. More on this below:

IndusInd Bank or “The Outcast”

Credit Underwriting

Ages back, he used to be a fierce fighter, a challenger, a leader of its ilk. Today he is merely a lone wolf. Shunned, Ignored and an Outcast…

Today IndusInd Bank is an outcast. Both from the minds of shareholders as well as from the hall of fame of banking. But just a few years back it was portrayed as a “Challenger to the Throne”. But after 2018 it fell drastically out of favor in recent years.

This fall from grace might appear tragic, but not entirely undeserved. The Challenger was a lot more reckless than it appeared. To cut the medieval age metaphor, IndusInd Bank got adverse observations from RBI in December 2017 regarding its lenient NPA classification.

Today, it is reeling under the sins of procedural mismanagement that first came to light in October 2021, and subsequently in December 2021, when whistleblower allegations were made for its microfinance arm.

One upside from this micro-crisis of IndusInd Bank is this: it is now clear that the management of the company has the best intentions at its heart. However, IndusInd Bank will take quite a bit of time to fix the operational mismanagement that is at the heart of its pains.

In a way, IndusInd bank is playing whack-a-mole with its problems. Just as it was recovering from its IL&FS exposure (it sold down its exposure to an ARC in Q3’22), it was beset by another problem - microfinance. While it has tried to get ahead of the problem, by provisioning aggressively, there is no assurance, that procedural missteps are not present in its loan book.

Liability Management

The Outcast is licking its wounds, trying hard to do what it can, accepting what it can’t and making peace with what it has. Sad is a warrior who doesn’t inspire anymore.

IndusInd bank has a poorer liability base than ICICI Bank and given its pedigree. 32% of its retail deposits -the least sophisticated source of funds, is in savings. 45% of its total corporate deposits will evaporate at the first sign of trouble. Its credit to deposit ratio is at 87% (much below the ideal 100%). IndusInd is stable, but growth will take time.

Strategy & Growth

…and yet, it still has a fight left in it.

INDUSIND, in the light of less than ideal liability management, it has turned its eyes towards bolstering its fee income, microfinance arm and streamline its loan book. After all, a less than stable deposit base can support only that much risk.

It has guided for a 13-18% RoE, yet it appears elusive in the light of its recent MFI problems and rising interest rates.

EQUITAS SFB aka “The Silent”

Credit Underwriting

They called him “The Silent”. Upright. Honorable. Taciturn. He fought the battle with honor and hoped the Gods would take notice.

Equitas SFB, otherwise “The Silent” in this Game-of-Thrones-esque narration - is a silent operator. Very much ignored, but an efficient operator nevertheless. With an above-the-cut underwriting ability, it has weathered Covid decently well.

ESFB focusses mostly on small business loans, microfinance, vehicle financing and SME/NBFC financing (in that order). All the three business lines are showing collections to the tune of 95%+.

What does this mean?

It means ESFB management hopes to surprise on the upside in the coming quarters. The loan book is “clean”, growth is returning back, and when the MFI portfolio stabilizes, it can be a great catalyst for re-rating.

Focussed on South India, ESFB loan book is “cleaner” than its North Indian compatriots and its restructuring initiatives have been a success by and large.

Liability Management

Equitas is a new bank. Its barely 5 years since it has got its banking license. Yet, 83% of its total borrowing is driven by its CASA + TD balances. This is stupendous, as they are generally low cost borrowings! Its cost of deposits has consistently trended down and its SA accounts are highly granular.

It is a mark of great liability management, from someone who is so young. Wouldn’t you agree, its epithet - “The Silent”?

Strategy & Growth

Its current strategy is 3 fold: scale down risky book (MFI), diversify its assets and raise more deposits. It is also making significant opex in digital space and is relying on fee income growth to power its RoE.

AU BANK aka “The Young”

Credit Underwriting

“The Young” is popular. He is the people’s fighter, warrior. The rich and the poor love him and he, in turn helps those who need his grace the most - the paupers and the poors. And yet, he fights better than most…

AUSFB is treading a difficult path. A path, that only a few have been able to successfully tread without tipping off. It is a “funder” of underdogs, the self-employed, non-professionals and those who are new to credit.

AU earns handsomely and lends to the non-lendable and the non-fundable. It calls its operating model as “the Robinhood model”. Take deposits from the rich, and lend to the poor.

It is skillful in its lending practices inspite of its clientele and inspite of COVID, it has a very sound loan book as evidenced by its collections. It has been consistently >100%. Only 3% of its new to credit customers in the wheels business have slipped to 90+days past due bucket. For SBL, it has been 2.1%.

Both are impeccable numbers in their own right, but what is even more stunning is, that these customers were just coming out of pandemic-induced lockdowns.

For everyone’s benefit, the segment “new to credit” is one of the most difficult segments to lend to, primarily because this segment often has no assets, very low-quality cash flow streams (seasonal and daily contracts), etc.

To have underwritten such a segment and having it perform this stupendously speaks volumes about the overall underwriting practices.

At a mere age of 5 years, it is both at the cusp of becoming a universal bank (hence “The Young”) and also experienced enough in the game to know how to play it.

Liability Management

“The Young”, knew his strength are the poor, as he is their strength…

Its strategy over the past few years has been to bolster its deposit base to bring down its cost of funds and boy, has it worked! It is doubling its savings deposit basis every 2 years and raising the CASA ratio by leaps and bounds (39% vs 22% YoY)

Strategy & Growth

It is gearing up for full transition to universal bank model complete with org. restructure, shared services model and a new vision. Its strategy is more of the same - keep growing retail deposit base, keep reducing the cost of borrowing, keep investing in digital processes and platforms.

Bandhan Bank aka “The Brawler”

Oh, “The Brawler”, what do we say about the animal? That he is “The Beast of The East”, that he is “The Great Bleeder”? That he fights bloody, gets mauled and yet he fights… There is nothing elegant about him. What set him apart was his ability to bleed. Blood and Pain…

Bandhan Bank is the brawler in this five-way comparison. Bandhan Bank, in our opinion is that brawler.

It is a 100-ton gorilla in East India’s microfinance space. A MFI market populated with aggressive competitors; low spending power and in general, low credit discipline.

In a bid to grow and outgrow its competitors, its loan book quality was sacrificed at the altars of growth. Even today, a full 24 months into the pandemic, it has one of the lowest collection numbers when compared to other banks.

Its Gross NPA is at a mindboggling 10.8% and its Net NPA at 3%. Right now, its management is congratulating itself on having arrested the rise in GNPA. Its overall collection efficiency is hovering at 96% and in MFI vertical it is seeing 92% collection efficiency (the MFI norm is ~99%). Even its non-NPA customers are not seeing a 100% collection efficiency (they are seeing a 97%).

Sample this, the total technical write-off the bank has done in merely 1 quarter (~12bn INR) is more than the total write-off the previous two SFBs have done over their entire lifetime.

The bulk of the loan book of Bandhan Bank is highly concentrated as can be understood from these two factoids:

One state alone accounts for 26% of non-paying customers for the bank

The current balance of the restructured pool is 34% of the total stress pool post payments (58bn out of 170bn, which was much higher earlier)

There is nothing ‘graceful’ or fine about Bandhan Bank. It seeks growth, risk be damned. Its size is the only saving grace and the reason for cushion, otherwise it would have been on the mat long back.

Liability Management

BANDHAN BANK’s CASA ratio stands at 43% - a number not too exciting, neither depressing. Its cost of funds hover at ~5.3%, markedly higher than ICICI BANK or INDUSIND BANK. Only saving grace? Its deposit base is highly granular, and forms 84% of its total deposits - in line with Equitas SFB.

Strategy & Growth

The Brawler aimed to win with his size; and yet forgot, that also made him hard to hide and easy to target…

Bandhan Bank has not quite articulated its strategy. After all, its hard to do it when you are always fighting a fire. Shortly after it went IPO, RBI imposed a condition on the promoter to dilute his holding - which it did by buying Gruh Finance. Soon thereafter, it was threatened with Assam microfinance scandal. And then COVID.

However in its FY21 AR, it has mentioned that its key focus will be to diversify its asset base, modernise its underwriting and collection capabilities (well diagnosed), and finally cross-sell. Of course, the mandatory homage to SMAC (social, mobile, analytics and cloud) is there - which I believe is a mis-match when its comes to its target demographics.

But then, that’s the Brawler for you. A strategy hard to decipher, if ever there was one…

Final Words

We tried to offer a 360-degree view of the current loan book and the state of the Indian banks across various sizes. The numbers are as of Q3’22, and their fortunes can also change as the quarters pass by. Part of the reason we did this piece is to bring growth-seeking startups to face to face with the very behemoths whose pie it aims to steal. As Sun Tsu said - “know yourself and know thy enemy, and you will be unvanquishable”!