Buy Now, Pay Later (BNPL): Too Good to Miss?

Click, Buy, Pay later with Interest-free monthly instalments. But, is it's so simple?

There are lots of questions to answer here. Why do retailers offer BNPL? Is it an alternative to credit card financing or an extension of it? Why consumers are willing to use it? What happens when you don’t have stringent underwriting or Fraud Controls? Are there any Dark patterns? Why Indian Banks are not fighting this battle? Is it really ‘Too Good to Miss’?

On the back of unbundling of Banking Services and ongoing consumer credit market liberalization, we can confidently conclude that “Buy Now, Pay Later” (BNPL) is here to stay and thrive.

If you are an investor in traditional banking & NBFC businesses, BNPL poses risks to your thesis. Risks that arise from the blind side are the most dangerous ones. As G.I. Joe says…

“Now you know. And knowing is half the battle.”

The Rise and Rise of BNPL.

Credit Suisse estimates BNPL to power 13% of eCommerce by FY26 vs. a puny 2.5% currently. That’s a 5x jump in relative terms. When one blends in the humongous growth e-commerce itself is witnessing, BNPL is set to grow at a stunning pace in absolute terms.

Critics point to BNPL, and scoff at its novelty(or lack thereof). They compare it with a humble credit card and blame it for packaging it in a new bottle product.

After all, credit card is an almost a century old concept, first started by Sears & Roebuck in 1911.

So BNPL is a marketing hype, right? Or is it?

Critics fail to see, BNPL is not just a credit card.

Its a consumer-tech UI product, which kills the numerous friction that prevents a customer from making lightning-fast purchases.

Its true power has been apparent only in this age of e-commerce, where businesses vie for reducing cart-abandon rates (fun fact: about 70% of customers never purchase even after filling their ‘carts’)

So as an investor, if you are gung-ho on e-commerce, and not on BNPL, are you really even bullish on e-commerce?

To re-emphasize: BNPL’s largest successes have come from 3 countries - Australia, German and Sweden, where it has been successful in increasing the basket size in transactions and reducing the friction.

The result?

BNPL has cornered about 1/10th of the market in Australia, 1/5th in Germany and a whopping 1/4th in Sweden.

So pervasive has been the adoption of BNPL in Sweden, that Klarna, a leading BNPL player in the country, processes 40% of all digital payments in Sweden.

Affirm, another BNPL provider and Klarna have reported that offering online BNPL solutions generated an 85% lift in average order value, a 20% repeat purchase rate and an increased customer conversion.

BNPL vis-à-vis Credit Cards - Round 2

E-commerce is the grand tide, that has lifted all ships. Credit card transactions have risen, and BNPL has soared.

Students of marketing guru, Philip Kotler, are well-aware of the 4-Ps of marketing: price, product, place and promotion.

But in this modern age, where e-commerce has upended the variable of ‘place’, the third P is increasingly turning out to be ‘payment terms’. Something which BNPL excel at. For customers, BNPL offerings give them a flexibility of repayment, often ranging from 14 to 30 days.

“Buy now, pay later” payment terms typically, allows consumers the option to split a purchase into several equal payments over a few weeks with generally no interest due or fees.

BNPL also claim to make life easier for merchants and lender. Merchants experience a higher-order value, conversion and repeat customers are some of the advantages. Afterpay, an Australian BNPL player, reports that 91% of their users are repeat customers.

But having said all that, critics are still quick to pounce, that credit cards are BNPL products themselves. But then, if a bank grows by 200% a year, regulators will come calling, but if a fintech doesn’t grow its BNPL product by that percentage, they will die a cold death.

And that’s where the difference lies. Growth, my lovely lady, growth!

In many ways, BNPL is the democratization of credit cards, which is forced to hold itself back under the growing regulatory scrutiny and costs as enunciated in Basel agreements.

Critics may call it a regulatory arbitrage, and for most parts, they may be right.

But slice and dice it in any way, BNPL is a poor man’s credit card and that is its greatest strength and its fatal flaw.

Chasing Growth in Indian BNPL

The Opportunity

65million credit cards.

INR 800billion of credit card payments1.

INR 654billion of UPI payments.

The Indian payments landscape is so huge that even a tiny sliver of the same can make fortunes.

Growth has fine prospects in this land, and financial inclusion is still a project in infancy. The payments landscape is segregated by purchase sizes. Big ticket purchases are financed via credit cards and small ticket items are powered by UPI payments.

But there is a whitespace, and a gaping one at that.

Imagine a lower-middle-class Indian, wishing to conduct an average-sized transaction, say a refrigerator. There is just no financial solution for him to rely on.

And he needs such a solution badly. Sometimes to purchase a refrigerator, other times to buy a 2 wheeler. Vast majority of India is still buying white consumer goods for the first time and they need credit to access these items.

BNPL solution is the only financial product that serves this need perfectly. Fitting like a glove, is an appropriate metaphor here, don’t you think?

This is the white space, that BNPL attacks, and investors will be well-served to pay attention here.

But an oft-ignored aspect of BNPL is the data that it harvests.

The value of this data is unsurpassable, as the financial picture of a customer is augmented by the consumption data.

Done successfully, a customer ‘profile’ put together this way, attempts to bridge two repositories of data in the modern world. Financial data that was earlier warehoused in banks, and digital data that was only available to the technology behemoths.

BNPL, meet growth ! Exhibit A

And why not? Capital Float, the in-house BNPL operator for Amazon informed financing INR 4.5billion worth of purchases during this year's Diwali, a whopping 200% jump from the last year2.

It also added 800,000 more customers, taking its total customer count to more than 3million.

A RedSeer report anticipates India’s online BNPL market disbursements to reach US$45-50bn by FY26, from the current USD 3- 3.5bn in FY21.

Recent RBI rules on auto-debit transactions can also prove to be a further catalyst for the BNPL sector. Auto-debiting can be very well replaced by a single BNPL operator who receives a single lump-sum payment from the customer. The vendor keeps his cash flow, the customer gets to enjoy interest-free convenience and the BNPL operator gets the data.

Credit on UPI: A filip for BNPL?

This year July, saw RBI and NPCI crack down on credit disbursements over UPI channel. The reason cited? User-verification concerns, or in other words KYC.

Prior to that, three lenders were front and center of this distribution innovation - Bullet(Jupiter), LazyPay (PayU) and FreoPay (MoneyTap).

While the industry awaits a regulatory nod to open credit distribution on UPI again, its a common knowledge that the scale of UPI can change the reach and extent of credit distribution.

The good news? Word on the street is, NPCI is interested as well, in bringing credit disbursement on its hitherto payment channel.

Growth at all costs: A bane for BNPL?

“Growth for the sake of growth is the ideology of the cancer cell”

-Edward Abbey

Everyone loves growth! VCs love it, entrepreneurs love it and so does the press. Yet, some businesses are just not meant for the growth, that VCs and entrepreneurs are used to.

Lending is not a consumer play and the hunger for growth leads to tremendous negative consequences.

The Adverse Selection Bias

In a bid to increase the number of clients, a lender is forced to compromise on the ‘bar’ for creditworthiness. Fraud and delinquencies soar and in a leveraged business like lending, that’s game over.

Economists love to name this as adverse selection bias. The wise like to call it: “all-bad, no-good, terrible side effects”.

The case of a leading BNPL.

This year Diwali, they acquired in 1 day, the number of customers that they used to acquire in a month in 2020.

This player, have been scaling up extremely aggressively and the growth is for all to see. But behind the facade of this growth, hides a dismal picture.

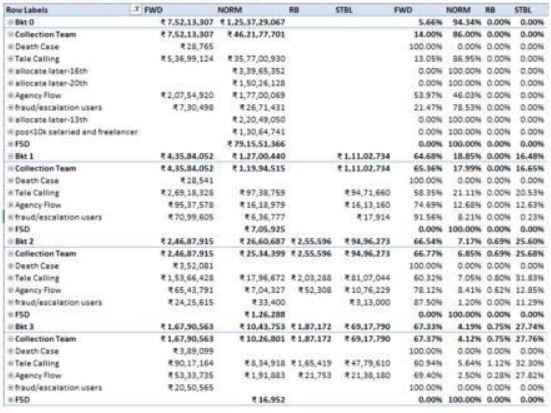

The following is a collection snapshot taken from the internal MIS analysis of the said BNPL player. This is as of October 2021.

The hazy-ness of the picture not-withstanding (sourced via WhatsApp, an app notorious for playing havoc with resolution), one thing is clear. The Bucket 0 (accounts with 0-29 days past due) are all out-of-whack, with forward flows ranging from 14% to 54% for different line items.

Slice and dice it in any way, this kind of forward flows for Bucket 0 is a leading indicator of a loan book turning sour at an astonishing pace.

But there is something even more stunning: there is a 0% of Roll-Back (RB) from Bucket 1, and just 0.7% from Bucket 2 & 3.

All this has happened for the customer acquired till SEP (EMIs were to be presented in 5th Oct, and then they have broken more records in shipping out their Cards around Diwali time!

The Systemic Risks of BNPL

BNPL at its core is an attempt to arbitrage the regulatory hurdles that are present for banks, NBFC, credit card companies etc.

Regulation poses costs on certain business behavior, in a bid to discourage activities that can pose systemic harms. Indiscriminate lending is one of them.

BNPL takes a sledgehammer and breaks through all regulatory scrutiny. Are they a technology company? No. Are they a financial company? No.

They are fin-techs. Residing just out of the jurisdiction of a traditional regulator, it evades any systemic oversight.

This lack of systemic oversight, coupled with its intense hunger for growth, can unexpectedly and unintentionally multiply the leverage of an Indian household. What’s worse, is there will be little to no means to monitor it.

Such a leveraging of household balance sheets, poses immense risk during an economic contraction. Either the households come under stress, or the BNPL lenders risk coming under such stress.

Either way, between widespread corporate and household delinquency, financial stability turns into an easy sacrifice.

Tackling the Ethical Angle: BNPL's Dark patterns

“Dark Patterns”- surreptitious user interface designs that trick users into doing things that they weren’t intended to do, most of the times acts that are harmful to their own interests. For example, BNPL interfaces can be designed in such a way, that users are tricked into spending more money (e.g. add-on products are added at the checkout without consent. Another example is, gamification for the repeated use of the service)

Another insidious way, is for e-commerce/BNPL players that build artificial barriers which prevent customers from making a price comparison. This is often implemented by a timer to force the customer into making a purchase.

e-Commerce interfaces can also play havoc by posting BNPL as a top option for the payments, in exchange for a portion of the processing fee. Coming down hard on this practice, a Swedish legislation3, passed in July last year, ruled that a payment method with credit, can not be displayed first, and can not be preselected if there are other payment methods.

“Privacy Zuckering”, another insidious practice where users are tricked into sharing more information about themselves than that was intended to, with permissions for data sharing with third parties hidden deep inside the fine print.

Each one of them are unethical practices, that thrive when BNPL players, hungry for growth decide that a revenue earned anyway which is kosher.

As they say, a lay-man looks into behavior, an intelligent man looks into incentives, but a wise man looks into the environment.

In an environment where growth is chased without heeding to the risks involved, breeds incentives where any form of earnings is celebrated.

What value then the interests of an average Indian hold?

The Road Ahead: Actionable Insights

Banks vs Fintechs: A classic case of underestimation?

Since 2008, banks have been criticized for taking it slow, steady and staid. “Legacy" institutions, they have been called, as they were almost inert on the face of disruption.

Battered by regulatory scrutiny, anemic loan book growth, dead low-interest rates and new regulations like Basel III, have made it uneconomical to operate in certain niches.

Its this whitespace, that fintechs are trying to occupy.

Fintechs with their new-age valuation-driven [🦄], VC-funded business model can afford to make losses. Take Jupiter for instance, the parent company of Bullet, a BNPL player remains pre-revenue as of FY21; yet expenses surged 4X to INR 260million 4. While valuations is at INR 2.2billion.

This kind of romanticism is not something banks can afford. On the flip side, fintechs in India are still not comparable with banks, when it comes to scale.

In a different metaphor, fintechs are the crazy person you meet in a dark alley, waving a knife, threatening to cut into you. You would be a darn fool to fight him. He has nothing to lose, perhaps even let loose on you by a henchman somewhere to check how well do you hold up. And you are a well to do man/woman who can do without that costly watch, or the 2 grand note in your wallet.

So you give. And live to fight another day. Is that cowardice? No, its tactics.

Fintechs in the business world, are the equivalent of the crazy man. Waving the knife crazily at you, not thinking twice of the consequences, high on drugs perhaps.

Banks are the equivalent of sane person walking down that alley. They have nothing to gain by engaging in the fight, but everything to lose.

As they say, when your enemies (fintechs) are making a mistake (of aggressive growth), its wise to let them make it. And, the mad rush for growth is just letting the bankers prune the worst of the clientele, and lose them to fintechs.

Best way to win this fight, is not to get into this fight.

The Beautiful Summer of BNPL: What will bring an end to it

Its a beautiful summer of growth that BNPL are experiencing currently. But it is for certain that the regulatory winter is coming. Once that sets in, the current regulatory arbitrage that BNPL have been able to reap so profitably will also wither away. To survive this BNPL players need to ensure that they provide a unique value-add beyond just ‘during purchase’ payment options, or building customer acquisition with rewards/cashback.

We anticipate three key challenges that would play out for BNPL players are:

Regulation : The regulatory winter is coming, and regulatory arbitrage will be made much less profitable than it is today

Maintaining Loan Quality: Fraud, Delinquency and NPA are the bane of traditional banking, and ought to be for BNPL players as well. If they fail to pay heed, any shock to the system will jolt them and throw them away. World still recounts the failure of Bear Stearns, but it is doubtful that a failure of a BNPL player will be missed

Leverage & Responsible Lending: The increasing instances of irresponsible lending could lead to the BNPL industry facing scrutiny from both regulators and consumers alike [Like the one we saw last year with respect to Chinese-Payday loans].

RBI report finds 600 illegal loan apps operating in India. After they got ~2,562 complaints from the customer from January 2020 to March 2021.

One can also argue that revenue challenges in the BNPL space persist. Revenue from merchants is about ~4-6% (Merchant Discount Rate - MDR) for international peers. This is not possible in India. And that is a challenge to the viability of BNPL players.

India is a flagbearer in payment infrastructure. A truly world class in its scope and execution, and the best thing? It's all free. UPI is an almost non-monetizable public-digital architecture.

Profitable in India: that has been the long-awaited and elusive goal of several startups in India.

Let’s conclude this, with a simple note for old economy folks, who often make fun of these new-age ideas on their profitability (or lack there-of).

Orthodoxy is to be immune to criticism, which will be dismissed without examination.

BNPL is here to stay and thrive. Go get it from most of the players! As Fintech players will keep looking for disruptions, new ideas will emerge. Perhaps something like a combo of BNPL and Credit card (as insensible it might seem), there is one in India.

Its still early days and its still summer. Pause a bit to smell the roses.

https://entrackr.com/2021/11/jupiter-remains-pre-revenue-company-in-fy21-expenses-surge-4x-to-rs-26-cr/

Hey Soham, could you elaborate and simplify more on what Forward Flows and Roll back means?

Excellent post. Collection is very important in Credit business. We have to see how these Fintechs will be able to efficiently collect the money back.